In this update, we have some changes to share with you, as well as valuable insights into the trends shaping the short-term rental market.

First and foremost, we have a new market claiming the coveted #1 spot on our list: South Bend, IN.

Additional markets & trends

Now, let’s delve into the overall trends we observed during our analysis.

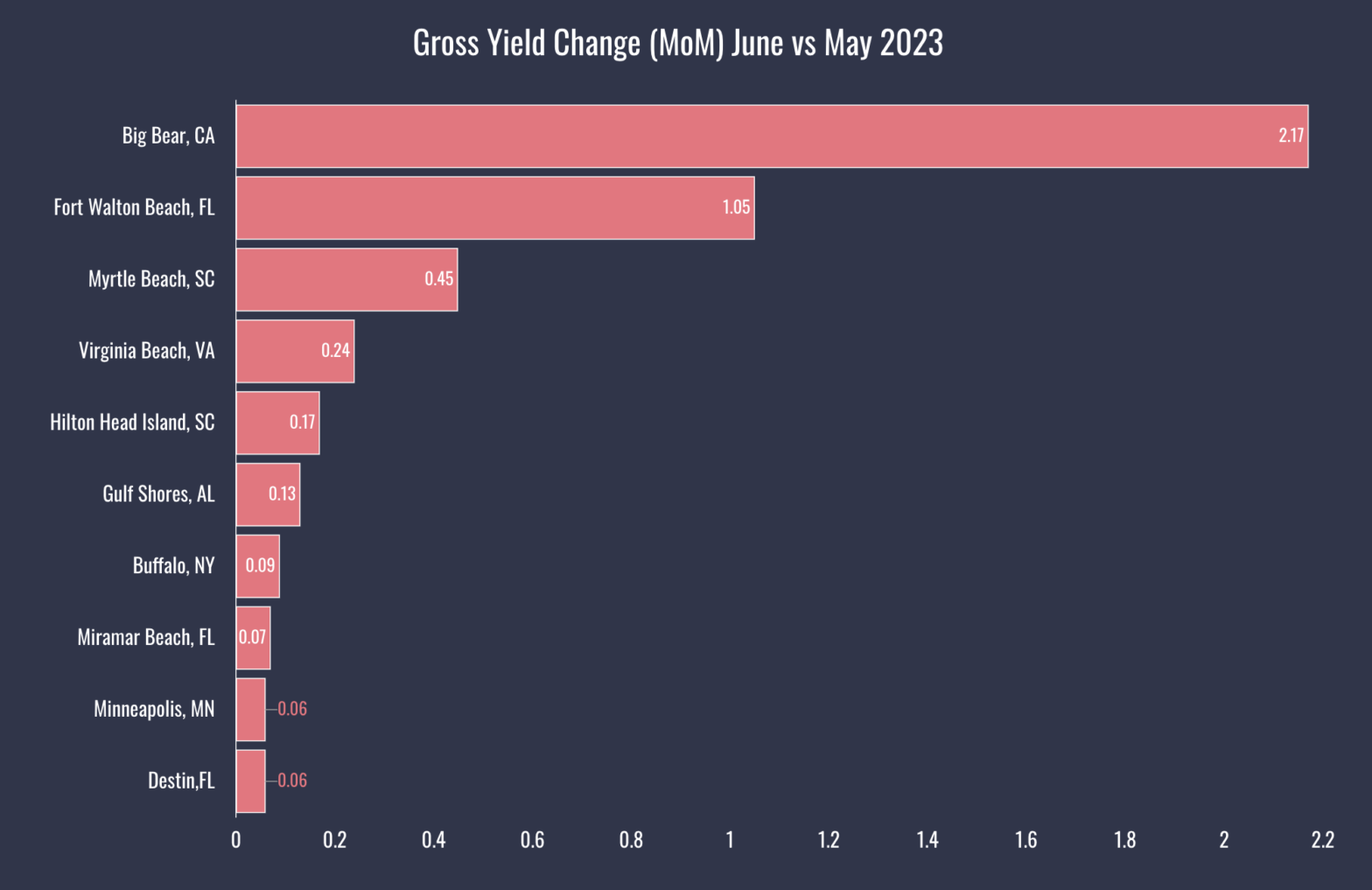

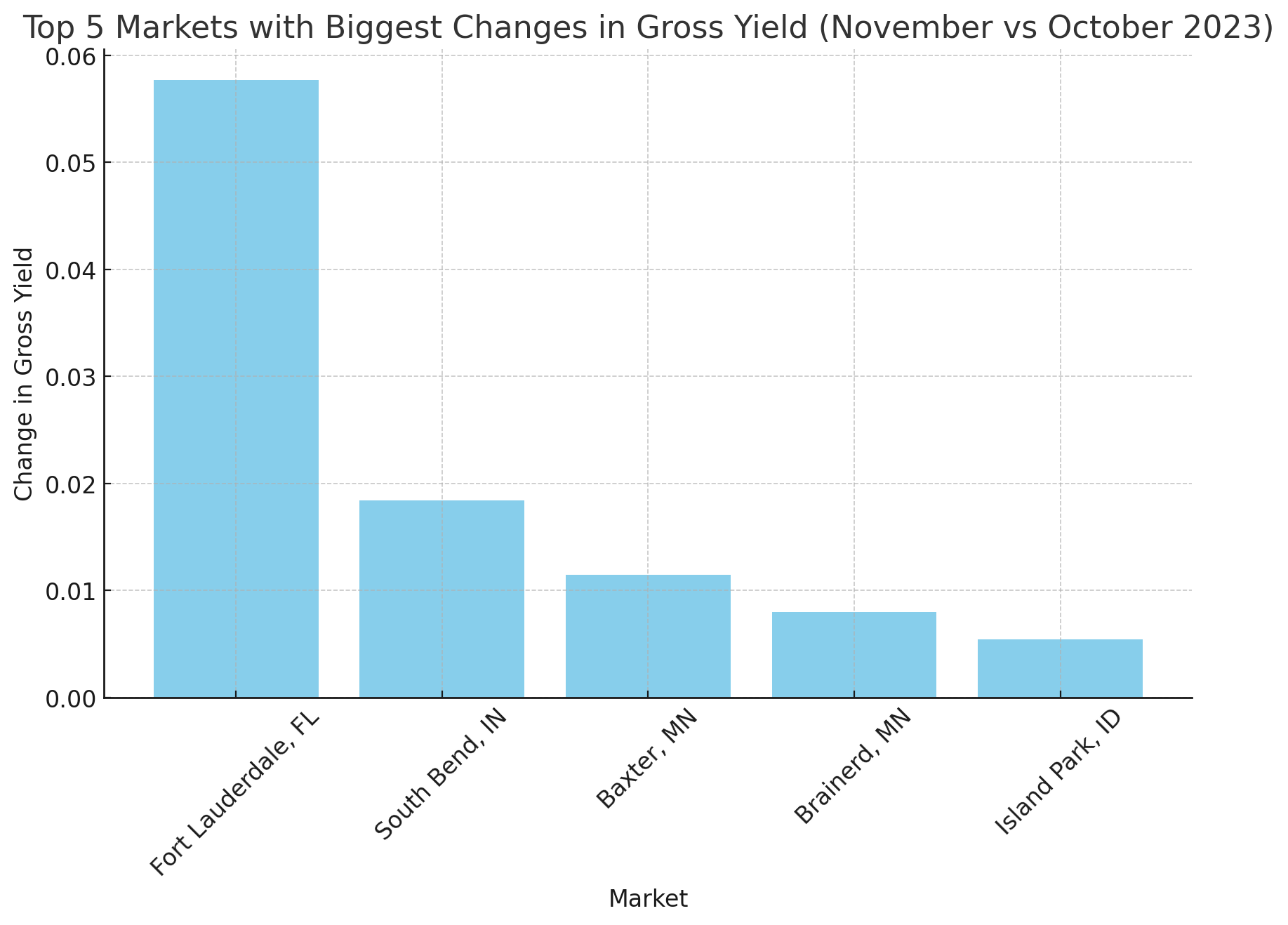

This month, we observed notable shifts in gross yield, a key metric for investors and property managers.

Key Findings (Top Performers):

- Fort Lauderdale, FL: Topping our list, Fort Lauderdale experienced a substantial increase in gross yield. This reflects a growing demand for rentals in this vibrant coastal city, making it a hotspot for short-term rental investments.

- South Bend, IN: South Bend showed a remarkable rise in its gross yield. The city’s unique appeal to tourists and business travelers alike might be driving this uptick.

- Baxter and Brainerd, MN: These neighboring Minnesota cities have witnessed significant growth. Their appeal as year-round destinations could be a contributing factor.

- Island Park, ID: Despite a slight decrease in home values, Island Park maintained a steady growth in gross yield, indicating a resilient rental market.

Markets Witnessing Yield Drops

Conversely, some markets have experienced decreases in their gross yield, suggesting varying challenges:

- Coachella, CA: This market faced a notable drop in gross yield, alongside a reduction in annual revenue.

- Cleveland, OH: The decrease in gross yield here, albeit with minimal change in annual revenue, points to shifting market dynamics.

- Cape Coral, FL: Experienced a dip in both gross yield and annual revenue, indicating potential market downturn.

- Kissimmee, FL: Saw a slight decrease in gross yield, possibly due to market saturation or local factors.

- Broken Bow, OK: This market’s slight decrease in gross yield and minor reduction in annual revenue suggest a subtle market shift.

As we continue to monitor the dynamic landscape of short-term rentals in the US, we remain committed to providing you with timely updates and valuable insights.

Whether you’re a seasoned investor or just dipping your toes into the real estate market, our blog aims to equip you with the knowledge and expertise you need to make informed investment decisions.

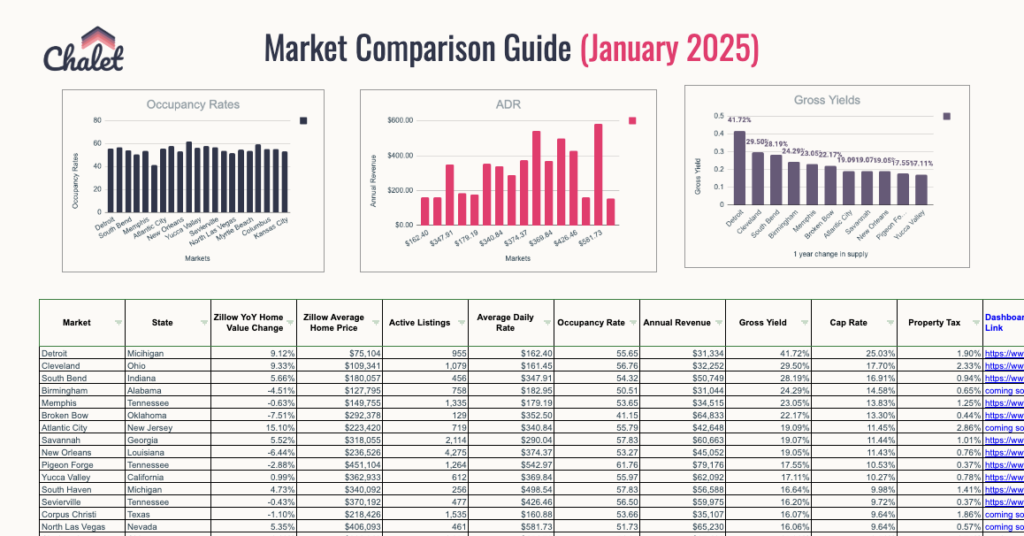

1. South Bend, IN

According to data from Chalet, there are currently 1,048 active short-term rentals in South Bend, IN. These rentals generate an average daily rate of $456 and an occupancy rate of 47%, resulting in an annual revenue of $77,500.

It is also worth noting that there has been a 12.57% increase in the supply of short-term rentals in South Bend when compared to Q3 of 2022.

According to Zillow, homes in the region have appreciated by 6.90%, with the median home value standing at $170,036.

The average gross yield for short-term rentals in the region is 45.58%. This is a strong indicator of the profitability of investing in short-term rentals in South Bend, especially given the relatively low property taxes in the area.

Check out our South Bend Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

2. South Haven, MI

According to data from Chalet, South Haven boasts a healthy short-term rental market with 1070 active listings.

This indicates a 15% increase in supply when compared to the third quarter of 2022, highlighting the growing interest among property owners to capitalize on the demand for vacation rentals in the area.

With an average daily rate of $539 and an occupancy rate of 60%, short-term rental owners in South Haven can expect a substantial annual revenue of $117,000.

South Haven Airbnb Investor Guide

3. Cleveland, OH

According to Chalet, there are currently 2146 active short-term rentals in Cleveland. These rentals have an average daily rate of $162.

The occupancy rate for short-term rentals in Cleveland is 53% which is lower than average for markets covered by Chalet. The annual revenue for short-term rentals in Cleveland is $31,600.

While this number may seem low compared to other cities, it’s important to note that Cleveland has a relatively low median home value of $98,314.

As a result, investors can enter the market with relatively low capital requirements. Moreover, the average gross yield for short-term rentals in Cleveland is 32.14%.

Cleveland Airbnb Investor Guide

4. Lake Harmony, PA

Based on data from Chalet, there are currently 636 active short-term rentals in Lake Harmony. These properties have an average daily rate of $562, which, when combined with an occupancy rate of 49%, results in an annual revenue of $100,800.

This translates to an average gross yield of 31.95%, indicating the potential for a lucrative return on investment.

According to Zillow, homes in Lake Harmony have experienced a healthy appreciation rate of 5%. This upward trend has contributed to a median home value of $315,478, making it an attractive market for potential buyers.

Lake Harmony Airbnb Investor Guide

5. Brainerd, MN

According to Zillow, Brainerd’s real estate market has seen a 3.50% depreciation in home values, which is currently at a median of $288,943. This may indicate that potential investors and homeowners are considering short-term rentals as a means to maximize their property’s income potential.

The short-term rental market in Brainerd is financially promising. The average daily rate for these properties is an impressive $407, leading to a healthy 61% occupancy rate. This equates to an annual revenue of $90,900, making it a tempting prospect for those looking to invest in short-term rentals.

With an average gross yield of 31%, it’s evident that Brainerd’s Airbnb market offers attractive returns.

Brainerd Airbnb Investor Guide

6. Atlantic City, NJ

Investors considering short-term rentals in Atlantic City will also want to evaluate the potential returns and expenses associated with such properties.

The average gross yield, which represents the return on investment before expenses, stands at 30.00%.

However, it’s essential to consider costs such as property taxes, which average 2.93% in Atlantic City, according to SmartAsset. Investors should factor in these expenses to get an accurate understanding of their potential profits.

Chalet, a leading provider of data and analytics for the short-term rental industry, reports that there are currently 1299 active short-term rentals in Atlantic City.

These properties generate an average daily rate of $343, contributing to an annual revenue of $57,200. However, despite the potential earnings, the occupancy rate for short-term rentals in Atlantic City sits at 46%.

Atlantic City Airbnb Investor Guide

7. Broken Bow, OK

The average daily rate for a short-term rental property in Broken Bow is $422 according to Chalet, a figure significantly higher than many other comparable markets.

This robust rate is reflective of the area’s popularity among vacationers, particularly those seeking a unique getaway in the scenic Oklahoma countryside.

Even with the increase in supply, the occupancy rate remains steady at 52%. Consequently, the average annual revenue for short-term rentals is an impressive $80,600.

Moreover, properties here have an average gross yield of 27.08%, suggesting that despite the associated costs, short-term rental properties in Broken Bow can provide a substantial return on investment.

Broke Bow Airbnb Investor Guide

8. Memphis, TN

Memphis is a major city in the state of Tennessee. It is known for its rich musical history, including the birthplace of rock and roll and the home of blues music.

The city is also home to various cultural institutions, including the National Civil Rights Museum and the Memphis Zoo.

Memphis, TN is another market worth considering for short-term rental investors. With an average gross yield of 25.93%, investors can expect a healthy return on investment. Moreover, the city has a growing tourism industry, which translates to a high demand for short-term rentals.

According to Zillow, the median home value is $142,688 as of February of 2024.

This city is a large metro with a population of 1.3 million and could be a positive factor for investors.

9. East Stroudsburg, PA

The average gross yield for short-term rentals in the area is 25.66% which suggests that East Stroudsburg could be a profitable market for investors.

However, it’s also worth noting that property tax rates in the area are relatively high. According to SmartAsset, the average property tax rate in Monroe County is 2.45%.

Another trend worth noting is the appreciation of home values in East Stroudsburg. According to Zillow, homes in the area appreciated 0.70% over the past year.

The median home value in East Stroudsburg is currently $284,493, which is slightly higher than the statewide median of $204,200. This suggests that there is demand for housing in the area, which could translate to increased demand for short-term rentals.

East Stroudsburg Airbnb Investor Guide

10. Sevierville, TN

As per Chalet, there are currently 8,748 active short-term rentals in Sevierville, TN. This large number signifies the popularity of the area among visitors.

The high demand for vacation rentals has resulted in an average occupancy rate of 67%, making it an attractive prospect for property owners.

The average daily rate for short-term rentals in Sevierville is reported to be $359, which contributes to the annual revenue of approximately $88,100. These figures highlight the potential for generating a solid income stream from short-term rentals in the area.

With an average gross yield of 23.46%, short-term rentals in Sevierville offer a promising return on investment for property owners.

Sevierville Airbnb Investor Guide

11. Fort Walton Beach

Located on the Emerald Coast in the Florida Panhandle, Fort Walton Beach is a family-friendly destination known for its white sand beaches and turquoise waters.

The city attracts visitors year-round, making it an excellent market for short-term rental investments.

According to Zillow, the median home value in Fort Walton Beach, FL, is $335,388, and homes have appreciated by 5.40%. These figures indicate a strong real estate market in the city.

There are currently 2,850 active short-term rentals in Fort Walton Beach, according to Chalet, with an average daily rate of $299 and an occupancy rate of 74%.

The annual revenue generated by short-term rentals in the city is $53,652, with an average gross yield of 23.45%.

Check out our Fort Walton Beach Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

12. Pensacola, FL

Located on the western tip of Florida’s Panhandle, Pensacola is known for its sugar-white beaches and crystal-clear waters. The real estate market in Pensacola is thriving, with homes appreciating by 7.90% over the past year, and a median home value of $247,364, according to Zillow.

Chalet reports that there are currently 3,855 active short-term rentals in Pensacola, with an average daily rate of $240 and an occupancy rate of 65%. This translates to an annual revenue of $37,992 for short-term rental properties in Pensacola.

The average gross yield for short-term rental properties in Pensacola is 23.45%, making it a strong return on investment for property owners.

Check out our Pensacola Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market.

Methodology

Our team of experts analyzes public data sources, including Chalet and Zillow, among others, to identify markets that offer high profitability and strong potential for growth. In this article, we will share our findings for the best markets to invest in short-term rentals in 2023 based on our latest research.

While the analysis above provides a strong starting point for short-term rental investors, it’s important to note that real estate investment is never purely based on numbers alone. For this analysis in particular we are putting emphasis on the gross yield metric.

Gross Yield = Annual Revenue / Home Purchase Price

Beyond just the gross yield, you should note that there are a variety of factors that should be taken into consideration when making an investment decision, such as the location of the property, the condition of the property, local regulations and taxes, and local market trends.

Conclusion

It is worth noting that the properties in these markets need to average at least 14% gross yield on average to be cashflow positive in today’s high-interest environment. Additionally, short-term rental investors should always research local regulations and licensing requirements before making an investment. Nonetheless, these markets offer promising investment opportunities for short-term rental investors in 2023.