Last updated: July 2025

Florida has been a top destination for short-term rental (STR) investors for years, but is it still as profitable in 2025?

Rising home prices, shifting regulations, and changing traveler preferences are reshaping the landscape. Some markets are thriving with record occupancy rates and high ADRs, while others face regulatory headwinds or oversaturation.

📊 Which Florida cities still offer high ROI for short-term rentals?

⚖ Where are the best STR-friendly regulations in the state?

📈 Which markets will continue to appreciate, and where is growth slowing?

This report breaks down the data—highlighting the top-performing STR markets in Florida for 2025 and offering insights into how investors can maximize returns.

Florida remains one of the most attractive states for Airbnb investors, but understanding emerging trends is critical to success in 2025.

A Shift Toward More Affordable STR Markets

🏡 Many of Florida’s historically top-performing STR markets—Miami, Orlando, and Key West—have seen home prices skyrocket.

🏖 Investors are turning to smaller, high-yield markets like Fort Walton Beach, Pensacola, and Tampa.

📉 In some areas, STR supply is increasing, putting downward pressure on ADRs.

📊 Occupancy rates remain high in most coastal and urban markets.

⚠ However, oversaturation in some areas is making it harder for new investors to stand out.

🏡 High-quality listings with premium amenities (pools, beachfront views, pet-friendly options) are outperforming the market average.

Regulatory Uncertainty in Some Cities

⚖ While Florida remains STR-friendly, some cities (like Miami and Orlando) have introduced more restrictive zoning laws.

🏡 Investors are shifting toward markets with clear, stable STR policies—like Fort Walton Beach, Pensacola, and Tampa.

How We Ranked the Best STR Markets in Florida for 2025

Using Chalet’s proprietary STR analytics, we evaluated hundreds of Florida markets based on:

📊 Annual Revenue & Occupancy Trends – Where STRs are earning the most.

🏡 Home Price & Appreciation Potential – The best markets for long-term growth.

⚖ Regulatory Environment – Where investors can operate without major restrictions.

📈 Supply vs. Demand – Where low competition drives higher pricing power.

Now, let’s break down some of the best-performing markets for STR investments in Florida in 2025.

- 📊 Which Airbnb rental markets are set to outperform in 2025 based on revenue growth, occupancy trends, and supply shifts.

- 🏡 Where home prices are still affordable while generating high rental income.

- 📈 How to identify markets with strong appreciation potential for both short-term cash flow and long-term gains.

- ⚖ Which cities have the best (and worst) STR regulations—so you don’t get caught off guard.

- 🔎 The demand trends driving guest bookings and what amenities maximize revenue in each market.

Top Short-Term Rental Markets in Florida for 2025

Here’s a snapshot of some of the highest-performing Airbnb investment markets in Florida:

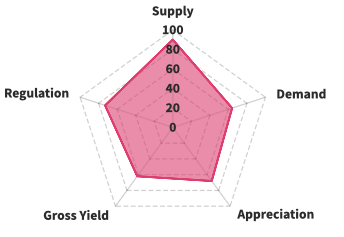

1. Fort Walton Beach, FL – Best for High Occupancy & Revenue

🏖 Median Annual Revenue: $48,020

💰 ADR (Average Daily Rate): $207.93

📊 Occupancy Rate: 72%

🏡 Median Home Price: $278,000

⚖ Regulatory Score: 70/100

Why It’s a Top Market:

✔ One of Florida’s highest occupancy rates at 72%.

✔ Beachfront properties have strong year-round demand.

✔ Relatively affordable home prices compared to other Gulf Coast cities.

✔ Investor-friendly regulations with clear short-term rental policies.

🔗 See Fort Walton Beach Market Data

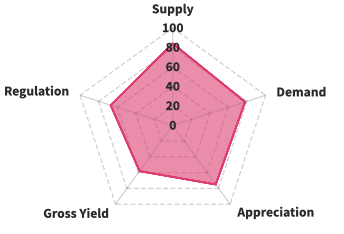

2. Pensacola, FL – A High-Yield Gulf Coast Market

🌴 Median Annual Revenue: $32,129

🏠 ADR: $176.08

📊 Occupancy Rate: 57.38%

💰 Median Home Price: $260,000

⚖ Regulatory Score: 70/100

Why It’s a Top Market:

✔ Pensacola Beach STRs command premium nightly rates.

✔ Affordable entry price compared to other beachfront Florida cities.

✔ High demand from military personnel, tourists, and snowbirds.

✔ Steady year-round occupancy despite seasonal fluctuations.

🔗 Explore Pensacola’s Market Trends

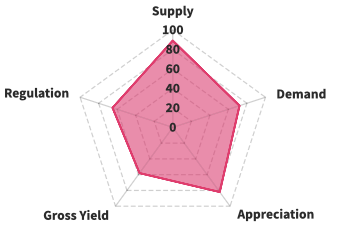

3. Tampa, FL – Best for Urban STR Investors

🌆 Median Annual Revenue: $31,529

🏡 ADR: $180.81

📈 Occupancy Rate: 59.4%

📊 Median Home Price: $390,000

⚖ Regulatory Score: 69/100

Why It’s a Top Market:

✔ Tampa’s mix of business travelers, sports fans, and vacationers creates strong year-round demand.

✔ Thriving entertainment scene (Ybor City, Busch Gardens, Raymond James Stadium).

✔ Certain neighborhoods remain STR-friendly despite evolving regulations.

4. Hollywood, FL – High-End STR Market Near Miami

📊 Median Annual Revenue: $59,204

🏡 Median Home Price: $480,000

📈 Occupancy Rate: 54.71%

💰 ADR: $324.32

⚖ Regulatory Score: 73/100

Why Invest Here?

✔ Luxury travelers drive high nightly rates.

✔ Close to Miami but with slightly more investor-friendly regulations.

✔ Beachfront properties command premium pricing.

✔ Steady mix of short- and mid-term rental demand.

5. Destin, FL – High Revenue, But Competitive Market

📊 Median Annual Revenue: $61,878

🏡 Median Home Price: $650,000

📈 Occupancy Rate: 63%

💰 ADR: $377.76

⚖ Regulatory Score: 67/100

Why Invest Here?

✔ Among the highest revenue-generating STR markets in Florida.

✔ Gulf-front properties maintain strong demand.

✔ Tourist-driven economy supports high ADRs.

✔ Increased competition means only premium properties thrive.

6. Key West, FL – High ADR & Year-Round Demand

📊 Median Annual Revenue: $103,633

🏡 Median Home Price: $$$ (One of Florida’s priciest markets)

📈 Occupancy Rate: 55%

💰 ADR: $462.00

⚖ Regulatory Score: 65/100

Why Invest Here?

✔ One of the highest ADRs in the state at $462.

✔ Luxury properties perform exceptionally well.

✔ Year-round demand due to Key West’s unique travel appeal.

✔ Strict zoning laws limit supply, preserving pricing power.

Final Thoughts: Where Should You Invest in Florida in 2025?

Florida continues to be one of the best STR markets in the U.S., but choosing the right city is critical to long-term success.

✅ Markets with stable STR regulations (like Fort Walton Beach, Pensacola, and Tampa) are attracting more investors.

✅ Premium properties in high-demand areas are outperforming basic listings.

✅ Smaller, emerging STR markets in Florida offer better affordability and ROI potential.

Want full rankings, revenue projections, and insights?

FREE Download NowWhy Investors Trust Chalet for STR Data

At Chalet, we provide:

✔ Real-time STR revenue & occupancy tracking.

✔ Market-by-market regulation insights.

✔ AI-powered tools to analyze STR profitability.

🚀 Start making data-backed STR investments today!

🔥 Want More Market Reports Like This?

🏝 Best Beach STR Markets in the U.S.

🏔 Top STR Markets in the Mountain West

🏠 Best STR Markets in Texas, Florida, and the Northeast