Last updated: January 2025

7 Step Guide to San Diego Rental Regulations

1. City Overview: Short-Term Rental Landscape

As of January 2025, San Diego’s real estate market has shown a 5.74% appreciation, with the median home value at $1,005,740. The city hosts approximately 10,781 active short-term rentals, with an average daily rate of $310, leading to an annual revenue of $54,618 per property.

San Diego is a popular destination for travelers, with Airbnb demand coming from cities like Los Angeles, CA (5.89% of all guests), San Diego, CA (5.22% of all guests), and Phoenix, AZ (3.29% of all guests).

The most popular property types in San Diego are 2-bedroom units, with an average daily rate of $310 and an annual revenue of $92,506. For more details, check out our San Diego Market Insights.

2. Quick Facts

- Chalet San Diego Investor Potential & Regulation Score: Friendly.

- Permit Required: Yes.

- Zoning Restrictions: Yes, STRs must comply with San Diego’s zoning regulations, which vary by property type and location, including caps for whole-home rentals in certain areas like Mission Beach.

- Maximum Occupancy: In San Diego, specific occupancy limits for Short-Term Residential Occupancies (STROs) are not explicitly detailed in the municipal code, but compliance with building and safety regulations establishes certain standards and requirements.

- Tax Requirements: Hosts must collect and remit a 10.5% Transient Occupancy Tax (TOT) and a 2% Tourism Business Improvement District (TBID) fee.

- Renewal Frequency: Every 2 years

- Insurance Required? The City of San Diego’s STRO regulations do not specify mandatory insurance requirements, but hosts are advised to maintain appropriate insurance coverage to protect against potential liabilities associated with short-term rentals.

- Enforcemnet Level: Strict

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

3. Getting Started with STRs in San Diego (Step-by-Step Guide)

Step 1: Understand Zoning Laws

Vacation rentals are permitted in various residential zones within San Diego. However, zoning laws and regulations, including density caps or other restrictions, are specific to the local jurisdiction and may vary. For example, the Mission Beach Community Planning Area has a cap on whole-home STRs (Tier 4), limiting them to 30% of the total housing units. Other parts of the city have a cap of 1% of the total housing units for whole-home rentals (Tier 3).

For zoning information specific to San Diego, use the Zoning and Parcel Information Portal (ZAPP), which allows you to check zoning information by address or parcel number. This tool provides insights into base zones, overlay zones, and other site-specific criteria.

For additional zoning questions or concerns, contact the Development Services Department:

- Website: San Diego Development Services

- Phone: 619-446-5000

- Email: dsdweb@sandiego.gov

- Address: 1222 First Avenue, San Diego, CA 92101

Step 2: Determine the Appropriate License Tier

San Diego offers four STRO license tiers, each with specific requirements:

- Tier 1: Part-Time

Renting the entire home for an aggregate of 20 days or less per year. The host does not need to reside onsite during the STRO. - Tier 2: Home Sharing

Renting a room or rooms in the home for more than 20 days per year, with the host residing onsite. - Tier 3: Whole Home (excluding Mission Beach)

Renting the entire home for more than 20 days per year, with the host not residing onsite. - Tier 4: Mission Beach Whole Home

Specific to the Mission Beach Community Planning Area, renting the entire home for more than 20 days per year, with the host not residing onsite.

Each tier has specific requirements and limitations. Here you can find out what tier you should get: STRO License Flow Chart and also please refer to the STRO Host Operating Requirements Checklist.

Step 3: Organize Required Documents

Before applying, ensure you have the following documents:

- Proof of Property Ownership: Documentation verifying your legal right to occupy the dwelling unit.

- Transient Occupancy Tax (TOT) Certificate Number: Required for all STR operations. If you need to register for a TOT certificate, please visit the TOT website or call (619) 615-1530.

- Right to Occupy: If you’re not the property owner, provide documentation showing authority to allow STRO activity.

- Local Contact Information: Name, full address, phone number, and email address of the local contact responsible for addressing complaints within one hour.

- Proof of Compliance with Building, Fire, and Safety Codes: This includes maintaining functional smoke detectors, carbon monoxide detectors, and fire extinguishers, as well as adhering to occupancy limits and ensuring proper emergency egress.

- Liability Insurance: While not explicitly required by law, liability insurance with a minimum coverage of $500,000 per occurrence is strongly recommended.

Step 4: Apply for an STR Permit

Applications must be submitted online through the Accela Citizen Access Portal. Here’s how:

- Create an Account: Register for an account on the portal.

- Complete the Application: Provide all required information and upload necessary documents.

- Pay Fees: Application and license fees vary by tier. For example, Tier 1 has a $25 application fee and a $100 license fee. Refer to the STRO Application/License Info Sheet for detailed fee structures.

For assistance during the application process, contact the Office of the City Treasurer:

- Email: stro@sandiego.gov

- Phone: 619-615-6120

- Address: 1200 Third Avenue, San Diego, CA 92101

After submission, your application will be reviewed. If approved, you’ll receive your STRO license, which must be displayed prominently at the property and included in all online or offline listings.

Step 5: Health and Safety Compliance

Vacation rentals in San Diego must adhere to strict health and safety standards, including:

- Smoke Detectors: Installed in each bedroom, hallways outside sleeping areas, and on every level of the property.

- Carbon Monoxide Detectors: Required for properties with gas appliances or attached garages.

- Fire Extinguishers: At least one Class 2A:10B fire extinguisher must be mounted in a visible and accessible location.

- Emergency Exits: Bedrooms must have an escape opening, such as a window or door, with minimum dimensions of 5.7 square feet, 24 inches in height, and 20 inches in width.

- Trash Management: Trash bins must be secured, and waste disposal must comply with local neighborhood guidelines.

- Good Neighbor Policy: Ensure guests respect neighbors and community standards to avoid complaints.

These health and safety measures are essential to ensure the safety of guests and compliance with San Diego’s STRO regulations. For further details, refer to the STRO Host Operating Requirements Checklist.

Step 6: Pay Taxes and Fees

- Application Fee: Tier 1 (Part-Time) – $25, Tier 2 (Home Sharing) – $25, Tier 3 (Whole Home) – $70, and Tier 4 (Mission Beach Whole Home) – $70.

- License Fee: Tier 1 (Part-Time) – $100, Tier 2 (Home Sharing) – $225, Tier 3 (Whole Home) – $1,000, and Tier 4 (Mission Beach Whole Home) – $1,000.

- Renewal Fee: Licenses are valid for two years from the date of issuance. Renewal fees are the same as the initial license fees and are due upon renewal.

- Report Filing: In San Diego, hosts with Tier 3 and Tier 4 Short-Term Residential Occupancy (STRO) licenses are required to submit quarterly reports to the City Manager. These reports must detail the number of days the dwelling unit was used for short-term residential occupancy during the reporting period. There is no fee associated with submitting these quarterly reports.

- Additional Taxes: Transient Occupancy Tax (TOT): 10.5% of the rent for stays under one month, paid monthly to the City. Tourism Marketing District (TMD) Assessment: 2% of the rent to fund tourism promotion, paid with TOT. Rental Unit Business Tax: Annual tax for rentals exceeding six days per year.

For the most current information and to apply for a license, visit the City of San Diego’s official STRO webpage

4. Regulatory Breakdown

Frequently Asked Questions provide detailed answers to the most common regulatory questions.

Example Questions:

- Do I need a permit to operate a short-term rental in San Diego? Yes, operating a short-term rental in San Diego requires obtaining an STRO license. There are four license tiers.

- What are the occupancy limits for STR properties in San Diego? In San Diego, while specific occupancy limits for Short-Term Residential Occupancies (STROs) aren’t explicitly detailed in the municipal code, compliance with building and safety regulations inherently establishes certain standards and requirements.

Local Ordinance and Other Useful Links:

STRO Host Operating Requirements Checklist

5. Key Considerations for Investors

What is the investment potential regulation score in San Diego?

San Diego has a regulated Short-Term Residential Occupancy (STRO) market with specific measures in place to balance tourism and residential needs. These regulations include zoning restrictions, density caps, and the enforcement of Good Neighbor Policies. Recent updates, such as the introduction of licensing tiers and caps on whole-home rentals, reflect the city’s growing efforts to maintain neighborhood harmony while sustaining investor opportunities. Investors should regularly monitor updates from the STRO San Diego website.

Are there any recent changes in STR regulations that could impact the market?

Recent updates to San Diego vacation rental regulations have included the introduction of stricter zoning rules and density caps. As of January 2025, whole-home rentals (Tier 3 and Tier 4) are capped at 1% of the city’s total housing units, with a 30% cap in the Mission Beach area. Additionally, Tier 4 licenses in Mission Beach have already reached capacity, with a waiting list for new applicants. On May 1, 2023, the city’s updated STRO ordinance went into effect, introducing these changes along with other requirements. Staying informed of future regulatory changes is crucial for compliance and successful investment in the San Diego STR market.

6. Taxes and Financial Obligations

- Occupancy Tax Rate: Vacation rental operators in San Diego must collect and remit a 10.5% Transient Occupancy Tax (TOT) and a 2% Tourism Business Improvement District (TBID) fee, for a combined total of 12.5%.

- Who Collects the Tax: Hosts are responsible for collecting these taxes from guests and remitting them to the City of San Diego. While some platforms like Airbnb may facilitate tax collection, it remains the host’s responsibility to ensure compliance.

- Insurance Requirements: While not explicitly required by law, it is strongly recommended that operators maintain liability insurance with a minimum coverage of $500,000 per occurrence to protect against potential liabilities..

- Payment Deadlines: Taxes must be filed monthly, even if no rental income is generated during that period. Hosts must follow the City of San Diego’s procedures for timely and accurate remittance of TOT and TBID fees.

- Filing Reports: In San Diego, hosts with Tier 3 and Tier 4 Short-Term Residential Occupancy (STRO) licenses are required to submit quarterly reports to the City Manager. These reports must detail the number of days the dwelling unit was used for short-term residential occupancy during the reporting period. This requirement ensures that hosts are utilizing their licenses in accordance with the regulations set forth in the STRO Ordinance.

- Ensure all tax filings align with the City’s procedures for compliance. For tax forms and details, visit the City of San Diego’s Short-Term Residential Occupancy Page.

7. How Chalet Can Help

- Local Realtor Partnerships:

Looking to invest in short-term rental properties? Chalet’s nationwide network of specialized realtors is here to guide you. Our experts understand the nuances of vacation rentals and local markets, helping you identify high-ROI properties and navigate complex regulations with ease. Best of all, their services come at no extra cost to you. Click here to connect for free. - Chalet’s Regulation Updates:

Chalet email subscribers receive updates regarding regulatory changes in cities. Subscribe here!

- Connect with Local Experts:

At Chalet, our goal is to enable everyone to create wealth with short-term rentals. We bring the experience and expertise to optimize your rental property. Connect with a STR professional in your area here.

Recommended Tools and Resources

- Chalet STR Market Insights Tool

Chalet offers a free market analytics tool that allows investors to explore detailed data on occupancy rates, average daily rates, revenue estimates, and market trends for specific cities. This tool helps investors make informed decisions based on comprehensive insights. Access the STR Market Insights Tool. - Airbnb Income Guide

Investors can dive into this guide to better understand how to maximize income from STRs. It covers critical aspects such as dynamic pricing, guest management, and how to boost profitability through effective listing strategies. Read the Comprehensive Guide to Airbnb Income. - Chalet Investor Guides

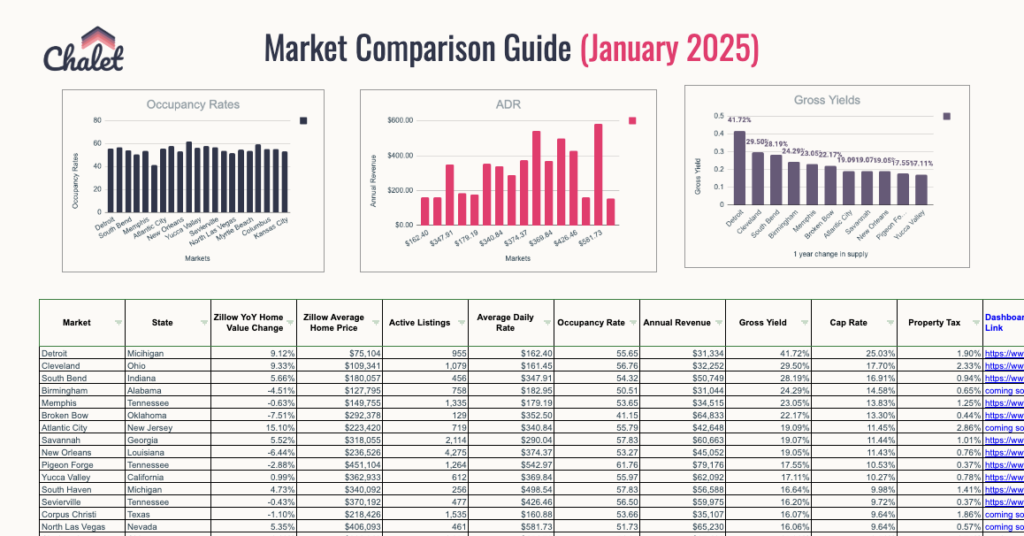

These investor guides provide city-specific insights, including tax obligations, regulations, investment potential, and detailed market data. Investors can select from over 200 city guides to find data tailored to their target market. Explore Investor Guides. - AI-Powered Market Comparison Dashboard

Chalet’s market comparison dashboard offers a powerful tool for comparing different STR markets based on yield, occupancy rates, and other key performance indicators. This tool is particularly useful for investors looking to diversify across different regions. Check out the Market Dashboard. - Chalet STR Calculator

The free Chalet STR Calculator is a powerful tool designed to help short-term rental investors evaluate potential property performance with ease. It enables users to estimate revenue, analyze expenses, and project profitability for any STR market, streamlining investment decisions. Whether you’re comparing properties or exploring new opportunities, the Chalet STR Calculator simplifies the process with precision. Learn more about the Chalet STR Calculator.

DISCLAIMER: The information provided in these guides is for entertainment and general informational purposes only. It may not reflect the most up-to-date regulations, and Chalet is not responsible for any inaccuracies or changes to the information on third-party sites. These guides are not legal advice. We highly recommend verifying details directly with local authorities and consulting professionals before making any investment decisions. Ultimately, it is your responsibility as an investor to ensure compliance with local laws.