Last updated: February 2025

7 Step Guide to Encinitas Rental Regulations

1. City Overview: Short-Term Rental Landscape

Encinitas is an investor-friendly location with short-term rental regulations favorable to those looking to invest in short-term rentals. As of October of 2024, Homes in Encinitas have appreciated by 0.99%, with the median home value standing at $363,313, according to Zillow.

There are currently 918 active short-term rentals in Encinitas. The average daily rate for these rentals is $370. This translates to an annual revenue of $64,832.

Encinitas is a popular destination for travelers, with Airbnb demand coming from cities like Los Angeles, CA (21.55% of all guests), San Diego, CA (5.05% of all guests), and New York, NY (4.12% of all guests).

The most popular property types in Encinitas are 2-bedroom units, with an average daily rate of $370 and an annual revenue of $42,720. For more details and the current information, check out our Encinitas Market Insights.

2. Quick Facts

- Chalet Encinitas Investor Potential & Regulation Score: Friendly.

- Permit Required: Yes.

- Zoning Restrictions: Allowed in all single-family homes and duplexes; prohibited in multi-family dwellings and new ADUs. Certain restrictions apply.

- Maximum Occupancy: Two guests per bedroom, plus one additional guest per dwelling except for partial home rentals.

- Tax Requirements: 10% Transient Occupancy Tax (TOT).

- Renewal Frequency: Annually.

- Insurance Required? Yes, $1,000,000 liability coverage.

- Enforcement Level: Strict

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

3. Getting Started with STRs in Encinitas

Step-by-Step Guide:

Step 1: Understand Zoning Laws

Short-term rentals (STRs) in Encinitas must comply with zoning regulations and neighborhood-specific limitations:

- Allowed Uses: STRs are permitted in single-family homes and duplexes but are prohibited in multi-family dwellings (e.g., apartments, condominiums) and newly constructed ADUs.

- Neighborhood Caps: Non-hosted STRs are subject to a citywide cap of 2.5% of total housing units, with a higher cap of 4% in the Coastal Zone.

- Proximity Restrictions: Non-hosted STRs must maintain a minimum distance of 200 feet apart to prevent overconcentration in neighborhoods.

To confirm your property’s zoning and eligibility, use the E-Zoning Map.

For assistance, contact:

City of Encinitas Development Services Department

Phone: (760) 633-2710

Step 2: Organize Required Documents

To apply for an STR permit, prepare the following:

- Proof of Ownership: Provide a grant deed or similar document.

- Short-Term Rental Permit Application: Complete the form via the Customer Self-Service Portal.

- Business Registration Certificate: $39 for initial registration; $24 for renewal.

- Transient Occupancy Tax (TOT) Certificate: STRs must collect and remit a 10% TOT. Register via the Finance Department TOT page.

- Site and Floor Plans: Include parking details, smoke and carbon monoxide alarms, and fire extinguisher locations.

- Liability Insurance: Provide proof of $1,000,000 minimum coverage.

- Neighbor Notification: Send a “Good Neighbor” letter to properties within a 300-foot radius.

Step 3: Apply for an STR Permit

Submit your completed application with required documents and fees through the Customer Self-Service (CSS) Portal. Fees include:

- Permit Application Fee: $425 (non-refundable).

Schedule a property inspection to verify compliance. Once approved, the STR permit must be prominently displayed at the property.

For detailed guidance, refer to the city’s Short-Term Rental Permit Application page.

For assistance, contact:

City of Encinitas Development Services Department

Phone: (760) 633-2710

Step 4: Health and Safety Compliance

STR properties must meet these safety standards:

- Smoke Detectors: Installed in bedrooms, hallways, and each floor.

- Carbon Monoxide Detectors: Required on every floor for properties with gas appliances or garages.

- Fire Extinguishers: One Class 2A:10B:C extinguisher per kitchen.

- Emergency Exits: Bedrooms must have proper egress.

Compliance is verified during a mandatory inspection before permit issuance or renewal.

Step 5: Pay Taxes and Fees

In Encinitas, operating a Short-Term Rental (STR) involves several fees and requirements to ensure compliance with local regulations. The primary fees include:

- Permit Fee: $425 annually.

- Business Registration: $39 initial, $24 renewal.

Additionally, STR operators must collect and remit a 10% Transient Occupancy Tax (TOT) quarterly. File TOT payments using the TOT Report Form. For instructions, refer to the TOT Guide.

4. Regulatory Breakdown

Frequently Asked Questions provide detailed answers to the most common regulatory questions.

Example Questions:

- Do I need a permit to operate a short-term rental in Encinitas? Yes, to operate a short-term rental (STR) in Encinitas, you must obtain a Short-Term Rental Permit. This permit is mandatory for renting any single-family home or duplex for 30 consecutive days or less.

- What are the occupancy limits for STR properties in Encinitas? Overnight occupancy is limited to two persons per bedroom plus one additional person per dwelling unit with the exception of partial home rentals.

Local Ordinance and Other Useful Links:

- Encinitas Municipal Code Chapter 9.38

- Short-Term Rental Permits

- Short-Term Rental Permit Application

- Customer Self-Service (CSS) Portal

- TOT Report Form

- TOT Report Instructions

- E-Zoning Map

5. Key Considerations for Investors

Investment Potential Regulation Score in Encinitas

Encinitas provides a moderately regulation-friendly environment for STVR investors. The combination of high tourist demand, clear rules, and annual renewal processes makes it a viable market. However, strict enforcement and zoning compliance are critical to successful operation.

Regulatory Changes

Last updates introduced in Ordinance No. 312 (effective October 15, 2019) added stricter penalties for non-compliance and enhanced occupancy, parking, and noise rules. Investors should stay informed through the Town of Encinitas’s website for updates.

6. Taxes and Financial Obligations

- Tax Breakdown: STVR operators must collect and remit a 7% Transient Occupancy Tax (TOT).

- Who Collects the Tax: Hosts are responsible for ensuring TOT is collected and remitted. Hosting platforms such as Airbnb or Vrbo may remit taxes on behalf of the hosts, but operators must verify compliance to avoid penalties.

- Payment Deadlines: Taxes must be reported monthly to the Town of Encinitas, even if no rental activity occurs during the reporting period. Late submissions may result in fines or permit suspension.

7. How Chalet Can Help

- Local Realtor Partnerships:

Looking to invest in short-term rental properties? Chalet’s nationwide network of specialized realtors is here to guide you. Our experts understand the nuances of vacation rentals and local markets, helping you identify high-ROI properties and navigate complex regulations with ease. Best of all, their services come at no extra cost to you. Click here to connect for free. - Chalet’s Regulation Updates:

Chalet email subscribers receive updates regarding regulatory changes in cities. Subscribe here! - Connect with Local Experts:

At Chalet, our goal is to enable everyone to create wealth with short-term rentals. We bring the experience and expertise to optimize your rental property. Connect with a STR professional in your area here.

Recommended Tools and Resources

- Chalet STR Market Insights Tool

Chalet offers a free market analytics tool that allows investors to explore detailed data on occupancy rates, average daily rates, revenue estimates, and market trends for specific cities. This tool helps investors make informed decisions based on comprehensive insights. Access the STR Market Insights Tool. - Airbnb Income Guide

Investors can dive into this guide to better understand how to maximize income from STRs. It covers critical aspects such as dynamic pricing, guest management, and how to boost profitability through effective listing strategies. Read the Comprehensive Guide to Airbnb Income. - Chalet Investor Guides

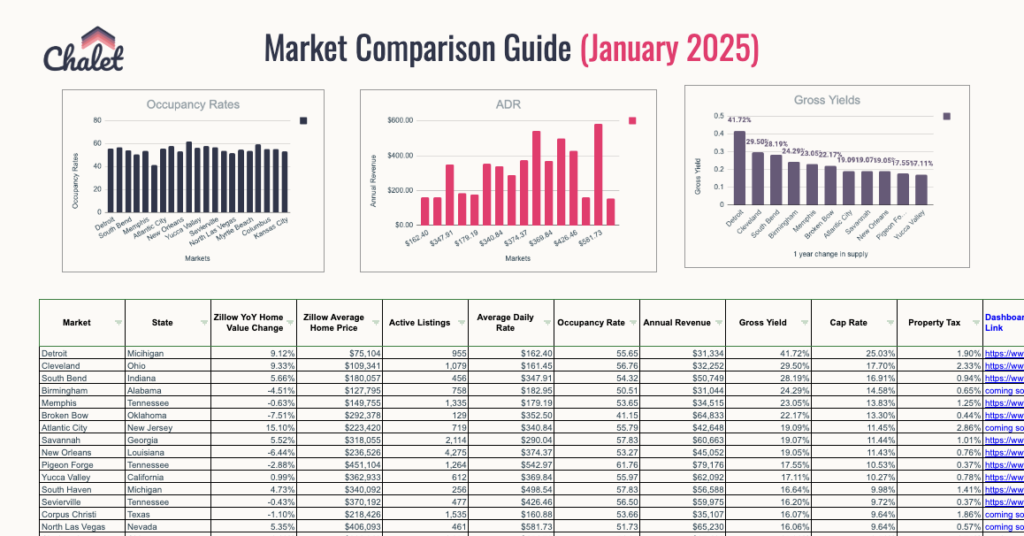

These investor guides provide city-specific insights, including tax obligations, regulations, investment potential, and detailed market data. Investors can select from over 200 city guides to find data tailored to their target market. Explore Investor Guides. - AI-Powered Market Comparison Dashboard

Chalet’s market comparison dashboard offers a powerful tool for comparing different STR markets based on yield, occupancy rates, and other key performance indicators. This tool is particularly useful for investors looking to diversify across different regions. Check out the Market Dashboard. - Chalet STR Calculator

The free Chalet STR Calculator is a powerful tool designed to help short-term rental investors evaluate potential property performance with ease. It enables users to estimate revenue, analyze expenses, and project profitability for any STR market, streamlining investment decisions. Whether you’re comparing properties or exploring new opportunities, the Chalet STR Calculator simplifies the process with precision. Learn more about the Chalet STR Calculator.

DISCLAIMER: The information provided in these guides is for entertainment and general informational purposes only. It may not reflect the most up-to-date regulations, and Chalet is not responsible for any inaccuracies or changes to the information on third-party sites. These guides are not legal advice. We highly recommend verifying details directly with local authorities and consulting professionals before making any investment decisions. Ultimately, it is your responsibility as an investor to ensure compliance with local laws.