7 Step Guide to Coachella Rental Regulations

1. City Overview: Short-Term Rental Landscape

Homes in Coachella have depreciated by -0.72%, with the median home value at $640,446, according to Zillow. The average property tax is 0.94%, per SmartAsset. These figures suggest potential investment opportunities for short-term rental (STR) investors due to favorable property tax rates and steady tourism demand.

Coachella currently has 3,942 active short-term rentals. The average daily rate for these rentals is $510, leading to an annual revenue of $58,433 as of January 2025. The average gross yield for STRs in the city is 9.12%. Despite a higher unemployment rate of 6.2% compared to the national average of 4.1%, Coachella remains a strong market due to consistent guest demand, particularly from Los Angeles, San Francisco, and San Diego.

The most popular property types are 2-bedroom units, with an average daily rate of $510 and an annual revenue of $75,774. Top-performing amenities include Cleaning before checkout, Garden or backyard, and Pianos, reflecting guest preferences.

2. Quick Facts

- Chalet Coachella Investor Potential & Regulation Score: Moderately Friendly.

- Permit Required: Yes.

- Zoning Restrictions: Yes, STRs must comply with Riverside County zoning regulations, which vary based on property type and location.

- Maximum Occupancy: Two adults per bedroom, plus two additional guests. Children under 12 are not included in occupancy limits.

- Tax Requirements: Hosts must collect and remit a 10% Transient Occupancy Tax (TOT).

- Renewal Frequency: Annually.

- Insurance Required? While not explicitly required by law, liability insurance with a minimum coverage of $500,000 per occurrence is strongly recommended.

- Enforcement Level: Strict.

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

3. Getting Started with STRs in Coachella

Step 1: Understand Zoning Laws

STRs in Coachella are permitted in residential zones and other areas based on specific zoning regulations outlined in Ordinance No. 348. Properties with ADUs or those located in restricted zones may not qualify for STR licenses. For zoning inquiries:

- Riverside County Planning Department:

Address: 4080 Lemon Street, Riverside, CA 92501

Phone: (951) 955-3200

View Ordinance No. 348 for zoning rules

Step 2: Organize Required Documents

- Proof of property ownership

- A valid business license

- Transient Occupancy Tax (TOT) certificate

- Completed health, building, and safety inspection forms

- Notification letters sent to neighbors (Good Neighbor Policy compliance)

- Proof of liability insurance (recommended minimum: $500,000 coverage)

Step 3: Apply for an STR Permit

Applications for STR Certificates must be submitted to the Riverside County Planning Department. The application includes a registration form, payment of fees, and scheduling of property inspections. Once approved, the STR Certificate must be displayed at the rental property.

- Riverside County Planning Department – STR Office:

Address: 4080 Lemon Street, Riverside, CA 92501

Phone: (951) 955-3200

Step 4: Health and Safety Compliance

STR operators must meet all health and safety standards, including:

- Functional smoke and carbon monoxide detectors

- Properly mounted Class 2A:10B fire extinguishers

- Clearly marked emergency escape routes in all bedrooms

- Trash management as per county guidelines (e.g., trash cannot remain outside for more than 24 hours before or after pickup)

Inspections: STR properties are subject to mandatory inspections. Owners can schedule inspections here.

Step 5: Pay Taxes and Fees

- Application Fee: $250 for the initial application

- Inspection Fee: $125 per inspection

- Annual Renewal Fee: $150 for renewal applications

- Good Neighbor Policy Exam Fee: $25 per exam

- Transient Occupancy Tax (TOT) Certificate Registration Fee: $75

- Payment Location: 4080 Lemon Street, Riverside, CA 92501

4. Regulatory Breakdown

Frequently Asked Questions provide detailed answers to the most common regulatory questions.

- Do I need a permit to operate a short-term rental in Coachella?

- What are the occupancy limits for STR properties in Coachella?

Local Ordinance Links:

5. Key Considerations for Investors

Investment Potential Regulation Score in Coachella

Coachella offers a moderately regulation-friendly environment for STR investors. Clear rules, annual renewal processes, and a high demand for vacation rentals (especially during festivals) make Coachella a viable market. However, strict enforcement and mandatory inspections ensure compliance.

Regulatory Changes

Recent updates, including Ordinance No. 927.2 (effective January 11, 2024), introduced enhanced penalties for violations and stricter enforcement of occupancy and parking requirements. Investors should stay updated via the Riverside County STR website.

6. Taxes and Financial Obligations

- Tax Breakdown: Vacation rental operators in Coachella are required to collect and remit a 7% Transient Occupancy Tax (TOT) and a 2% Tourism Business Improvement District (TBID) fee, for a combined total of 9%.

- Who Collects the Tax: Operators are responsible for ensuring the collection and remittance of these taxes. Hosting platforms, such as Airbnb and Vrbo, may collect and remit TOT and TBID on behalf of the hosts, but operators must verify compliance to avoid penalties.

- Payment Deadlines: Taxes must be remitted monthly to the City of Coachella, even if there is no rental activity during the reporting period. Late submissions can result in fines or license non-renewal.

- Insurance Requirements: All vacation rental operators must maintain liability insurance with a minimum coverage of $500,000 per occurrence to comply with city regulations. This ensures protection against potential claims or liabilities associated with vacation rental operations.

7. How Chalet Can Help

- Local Realtor Partnerships:

Looking to invest in short-term rental properties? Chalet’s nationwide network of specialized realtors is here to guide you. Our experts understand the nuances of vacation rentals and local markets, helping you identify high-ROI properties and navigate complex regulations with ease. Best of all, their services come at no extra cost to you. Click here to connect for free. - Chalet’s Regulation Updates:

Chalet email subscribers receive updates regarding regulatory changes in cities. Subscribe here! - Connect with Local Experts:

At Chalet, our goal is to enable everyone to create wealth with short-term rentals. We bring the experience and expertise to optimize your rental property. Connect with a STR professional in your area here.

Recommended Tools and Resources

- Chalet STR Market Insights Tool

Chalet offers a free market analytics tool that allows investors to explore detailed data on occupancy rates, average daily rates, revenue estimates, and market trends for specific cities. This tool helps investors make informed decisions based on comprehensive insights. Access the STR Market Insights Tool. - Airbnb Income Guide

Investors can dive into this guide to better understand how to maximize income from STRs. It covers critical aspects such as dynamic pricing, guest management, and how to boost profitability through effective listing strategies. Read the Comprehensive Guide to Airbnb Income. - Chalet Investor Guides

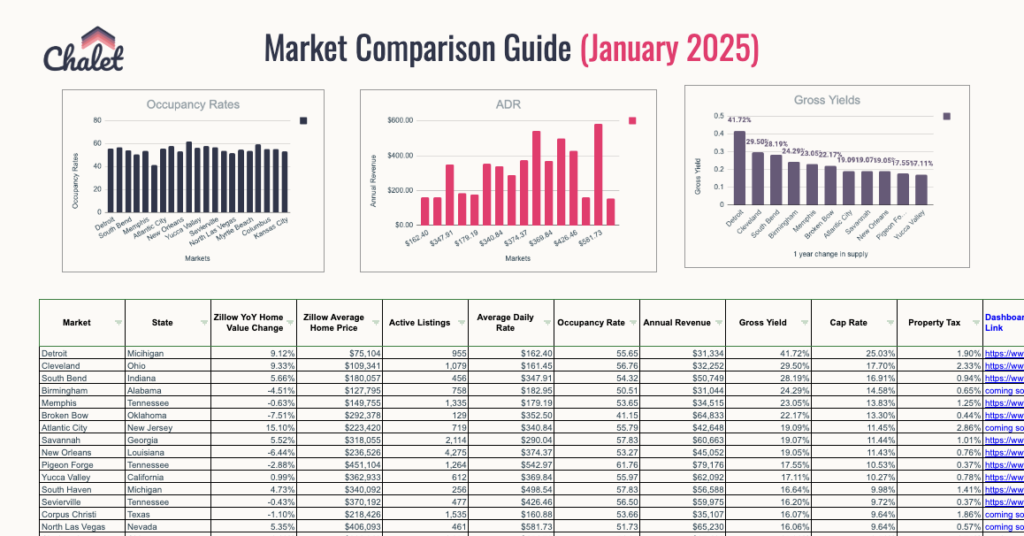

These investor guides provide city-specific insights, including tax obligations, regulations, investment potential, and detailed market data. Investors can select from over 200 city guides to find data tailored to their target market. Explore Investor Guides. - AI-Powered Market Comparison Dashboard

Chalet’s market comparison dashboard offers a powerful tool for comparing different STR markets based on yield, occupancy rates, and other key performance indicators. This tool is particularly useful for investors looking to diversify across different regions. Check out the Market Dashboard. - Chalet STR Calculator

The Chalet STR Calculator is a powerful tool designed to help short-term rental investors evaluate potential property performance with ease. It enables users to estimate revenue, analyze expenses, and project profitability for any STR market, streamlining investment decisions. Learn more about the Chalet STR Calculator.

DISCLAIMER: The information provided in these guides is for entertainment and general informational purposes only. It may not reflect the most up-to-date regulations, and Chalet is not responsible for any inaccuracies or changes to the information on third-party sites. These guides are not legal advice. We highly recommend verifying details directly with local authorities and consulting professionals before making any investment decisions. Ultimately, it is your responsibility as an investor to ensure compliance with local laws.