In the realm of high-end vacation properties, identifying lucrative markets for luxury Airbnb rentals is paramount for savvy investors. Across the US, opulent neighborhoods and exclusive destinations beckon those looking to invest in premium accommodations that promise not only elegance but also great returns. This segment focuses on investors seeking unique experiences in some of… Continue reading Best Luxury Airbnb Rental Markets

Best Airbnb Markets in the West

The West, with its vast landscapes ranging from lush coastal regions to stark desert beauty, holds a treasure trove of opportunities for Airbnb and short-term rental investors. This dynamic region is renowned for its diverse cities, each offering unique cultural experiences, natural wonders, and vibrant communities that attract millions of visitors each year. As we… Continue reading Best Airbnb Markets in the West

Best Airbnb Markets with Low Property Tax

In the quest to maximize returns on Airbnb and short-term rental investments, savvy investors often seek markets that combine the allure of high average gross yields with the benefit of low property tax rates. Identifying such markets is crucial for optimizing investment returns and minimizing overhead costs. With property taxes being a significant recurring expense… Continue reading Best Airbnb Markets with Low Property Tax

Best Airbnb Markets in North Carolina

North Carolina, a state rich in diversity and natural beauty, offers an unparalleled blend of landscapes that cater to every type of adventurer and investor alike. From the majestic peaks of the Blue Ridge and Great Smoky Mountains to the serene beaches of its vast coastline, North Carolina stands as a testament to the allure… Continue reading Best Airbnb Markets in North Carolina

Best Airbnb Markets in South Carolina

South Carolina, with its enchanting blend of historical charm and natural beauty, presents a captivating scene for Airbnb and short-term rental investors. This Southern jewel, from the cobblestone streets of Charleston to the sun-drenched beaches of Myrtle Beach, the lush upstate mountains, and the serene beauty of Hilton Head Island, attracts a wide array of… Continue reading Best Airbnb Markets in South Carolina

Best Budget-Friendly Airbnb Rental Markets

In the quest for lucrative Airbnb and short-term rental markets, investors often face the challenge of finding the perfect balance between affordability and profitability. This exploration leads us to uncover some of the best budget-friendly Airbnb rental markets, where the average home price, as per Zillow, falls below the $400,000 mark. These hidden gems not… Continue reading Best Budget-Friendly Airbnb Rental Markets

Best Airbnb Markets in Arizona

Arizona, known for its diverse landscapes and sunny weather, offers excellent opportunities for short-term rental investors. From vibrant cities to scenic desert destinations, these markets provide strong investment potential. Stretching from the majestic Grand Canyon to the serene deserts of Tucson, and from the bustling streets of Phoenix to the red rocks of Sedona, Arizona… Continue reading Best Airbnb Markets in Arizona

Best Airbnb Rental Markets in Tennessee

Nestled within the vibrant landscapes of the Southeastern United States, Tennessee stands as a beacon for travelers and real estate investors alike, offering a unique blend of cultural richness, historical depth, and natural beauty. From the soulful rhythms of Memphis to the country music heartbeats of Nashville, and from the scenic trails of the Great… Continue reading Best Airbnb Rental Markets in Tennessee

Tax Implications for Short-term Rentals: Schedule E vs. Schedule C

Navigating the tax landscape for short-term rentals can be complex, yet understanding it is crucial for property owners to ensure compliance and optimize their tax obligations. The classification of rental income between Schedule E (Supplemental Income and Loss) and Schedule C (Profit or Loss from Business) under the U.S. tax code is a pivotal decision… Continue reading Tax Implications for Short-term Rentals: Schedule E vs. Schedule C

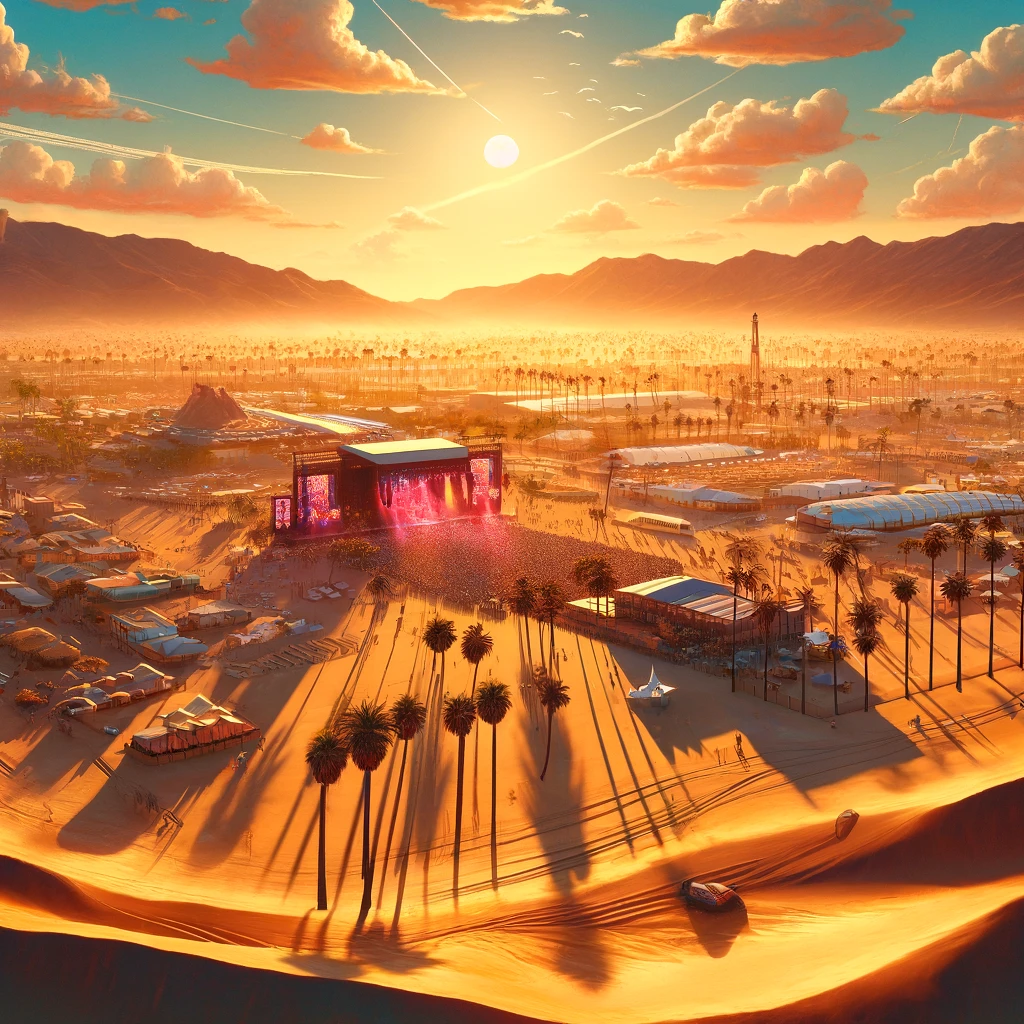

Best Airbnb Rental Markets in California

California, with its diverse landscapes and vibrant cities, offers excellent opportunities for short-term rental investors. From scenic coastal destinations to bustling urban areas, these markets provide strong investment potential. Within this dynamic state lies a plethora of Airbnb rental markets, each offering a unique blend of charm, adventure, and relaxation. From the sun-kissed shores of… Continue reading Best Airbnb Rental Markets in California