(Gross Yields from 13.24%, $224 Average Daily Rate)

This is the latest in our series of investor guides we release for free to our investors and everyone interested in Short-Term (Airbnb) Rentals.

For this analysis, we have used the trailing twelve months (October 1st, 2021 to September 30th, 2022). See our previous post for historical data.

These investor guides along with market reports cover Encinitas, Carlsbad, and Oceanside as they have friendly climates for short-term rental investors. See our post on regulation in these markets.

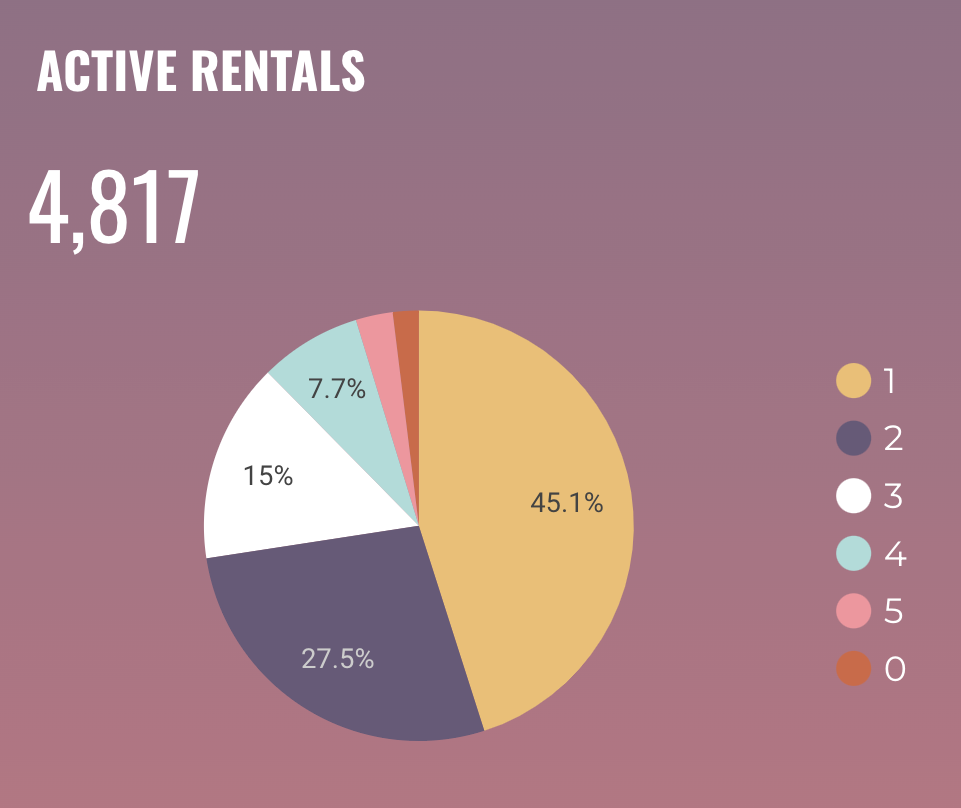

Active Rentals

There are 4817 active rentals in San Diego. Almost 68% of all listings are 1 and 2-bedrooms.

Smaller homes catering to couples can be undersupplied. There are only 94 active studios.

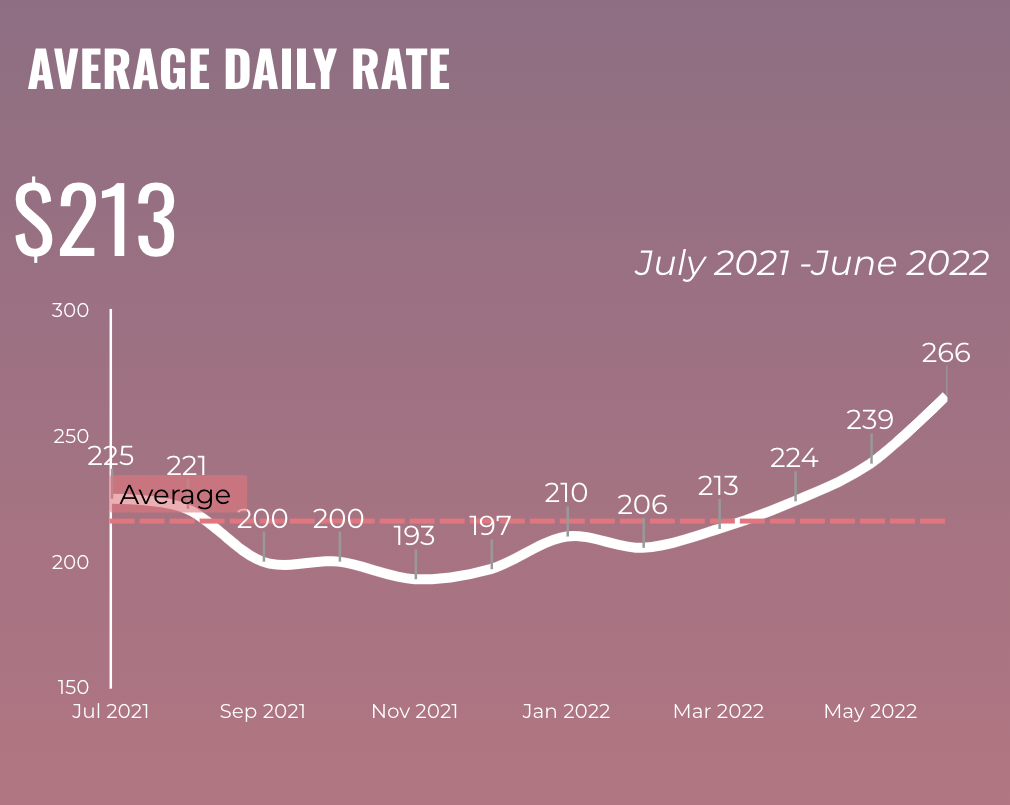

Average Daily Rate (Nightly Price)

The Average Daily Rate for rentals in San Diego is $224.

Throughout the year, the rate fluctuates by $50 from that average with the highest Average Daily in July 2022 ($284) and the lowest in November 2021 ($193).

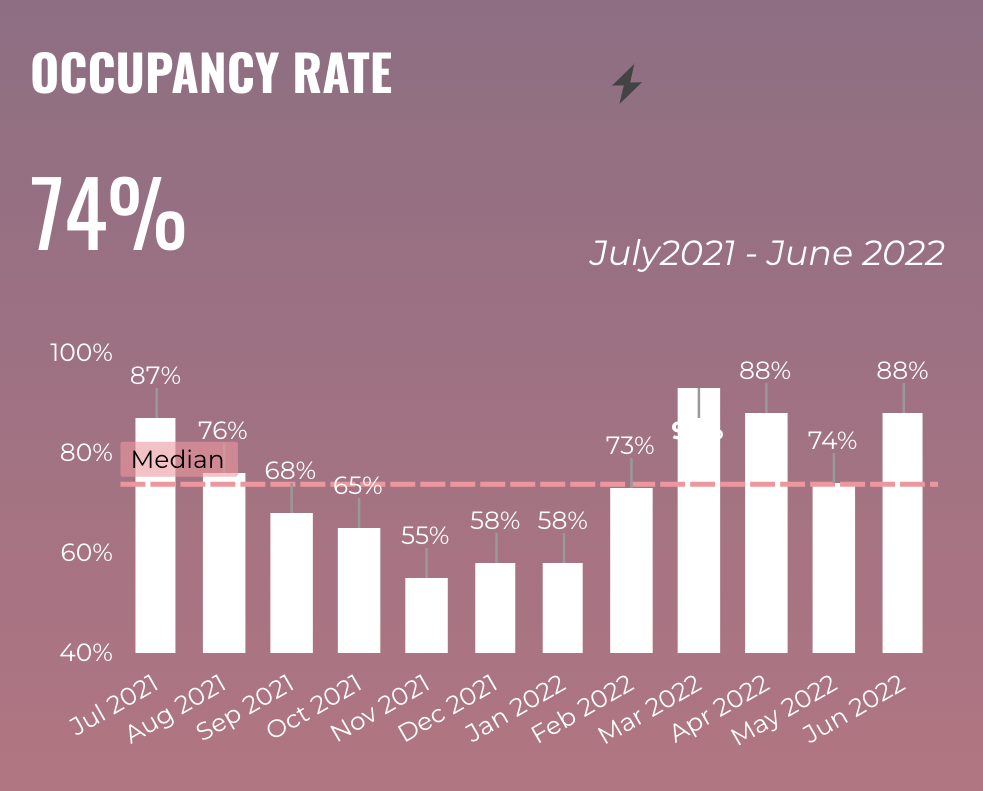

Occupancy Rate

Occupancy Rates in San Diego, California are the highest in the summer and the last 12 months, the highest occupancy was in July 2022 at 96%. The Occupancy Rate at an annual level is 76%.

The lowest occupancy rate was in November 2021 (55%) and the highest was in July of 2022 (96%). This anomaly with March occupancy rates can be best explained by the limited number of listings available for rent in the Spring of this year.

Get projections on revenue, average daily rate, cap rates, and a lot more.

High-Performance Properties

Chalet’s research shows that 4-bedroom homes have the highest percentage of homes in the high-yield territory (25.61%) and therefore could be a good strategy for this market. Studios do not have enough samples to be considered (no active listings).

Chalet considers properties with a gross yield greater than 15% as high-yield properties. Gross yield equals Gross Income/Purchase Price

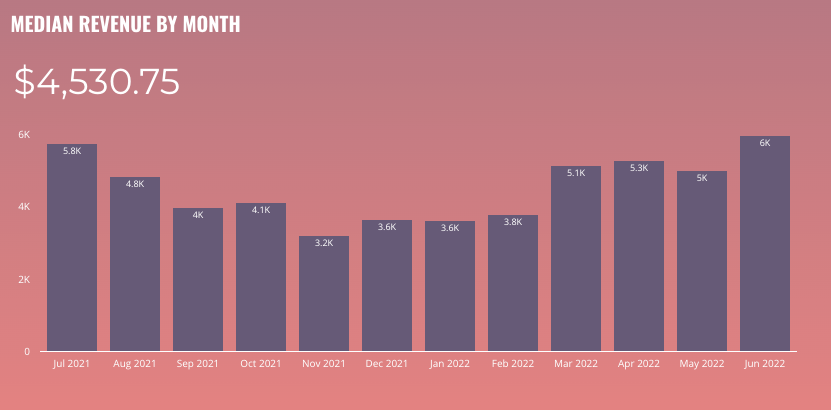

Annual Revenue

The median revenue is the highest in July 2022 at $7150 and the lowest in November 2021 at $3212.

Short-term rentals in San Diego generate a median revenue of $84,169 annually. The highest median revenue for rentals in San Diego is for 5 bedrooms at $158,100.

Throughout the year, monthly revenue fluctuates the most for 5-bedroom homes and the least for 1-bedroom homes. More conservative investors should look into 1 bedroom investment properties as data shows they are the most stable and predictable.

Demand

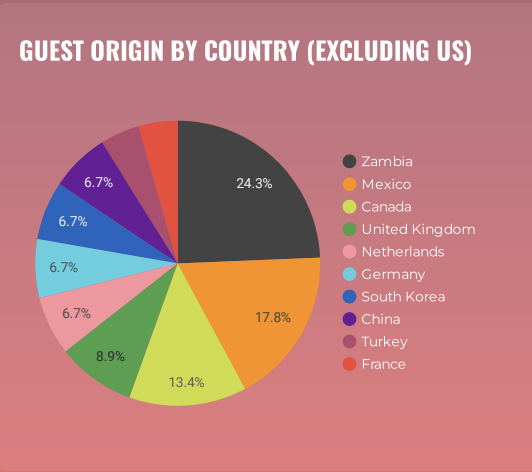

The majority of the San Diego short-term rental guests are domestic guests from the United States, though January is when the presence of international guests is most noticeable. However, international guests in February barely crossed the 1% threshold of total guests.

The majority of San Diego guests come from U.S. cities located within driving distance. Almost 25% of all guests in San Diego are from San Diego. We expect drive-to locations/cities to continue to do well in the post-covid world.

Market Facts

Population – City – 1,307,402 (2020), Metro – 3,095,313 according to US Census Bureau

- MacroTrends states that San Diego is currently growing at a rate of 0.7% annually since 2021. As a benchmark, FreddieMac states that US cities grow at an average of 0.3%.

- Famous for its sunny weather and impressive beaches

Cost of Living: Payscale ranks the cost of living in San Diego to be 44% higher than the national average. San Diego also has 136% higher housing expenses than the national average.

Other Facts

San Diego County has an effective property tax rate of 0.73%. That’s slightly lower than the 1.07% national average. Source: SmartAsset.

According to Zillow, homes in San Diego appreciated 10.3% year-over-year (YoY) and the median home price for active listings was $993,317 (as of December 2022).

Homes in San Diego average just 28 days on the market according to Redfin.

The BLS reported that the unemployment rate in San Diego County fell to 3.2% in October of 2022, which is lower than the national average of 3.8%.

Short-Term Rental Regulation

See Chalet’s detailed analysis of short-term rental regulation in San Diego county.