Introduction

South Bend, home to the University of Notre Dame and known for its rich history and revitalized downtown, offers a diverse range of opportunities for short-term rental investments. The city’s steady influx of students, tourists, and business travelers ensures a strong demand for rentals year-round. Here’s a breakdown of the top-performing zip codes for short-term rental investments, including gross yields, annual revenues, Zillow home values, and insights into each area.

46614: Erskine Park & Southside South Bend

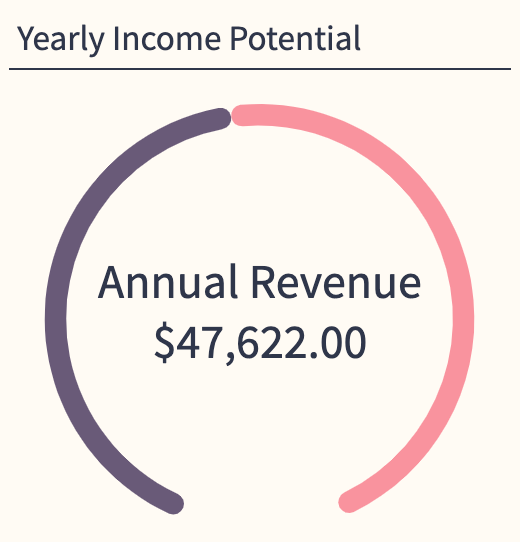

- Gross Yield: 21%

- Annual Revenue: $47,622

- Zillow Home Value: $224.3K

Zip code 46614 encompasses neighborhoods like Erskine Park and Southside South Bend, which are known for their suburban feel, tree-lined streets, and proximity to Erskine Golf Course. With the highest gross yield on this list at 21%, investors can expect significant returns, supported by an impressive annual revenue of $47,622. The Zillow home value of $224.3K reflects the area’s desirability and stability, making it a sound investment choice. The presence of shopping centers and easy access to major highways further boosts its rental appeal.

46616: Near West Side & LaSalle Area

- Gross Yield: 20%

- Annual Revenue: $28,320

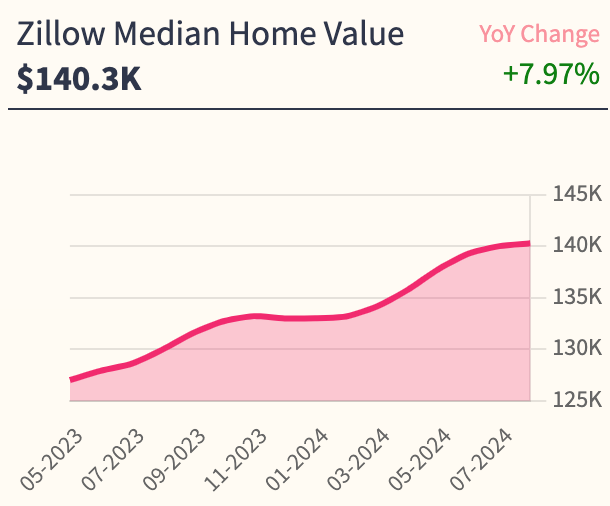

- Zillow Home Value: $140.3K

This zip code covers the Near West Side and the historic LaSalle Area, where charming older homes are a key attraction. The gross yield here is a strong 20%, and annual revenue is $28,320, making it a lucrative investment option. The affordable Zillow home value of $140.5K provides a low barrier to entry for investors. The area’s rich history and proximity to downtown South Bend make it appealing to tourists and renters seeking a unique, historic experience.

46615: River Park & East Bank

- Gross Yield: 18%

- Annual Revenue: $29,450

- Zillow Home Value: $164.6K

Zip code 46615 includes River Park and parts of the East Bank neighborhood, known for their close proximity to the St. Joseph River and recreational areas like Howard Park. With a gross yield of 18% and annual revenue of $29,450, the area presents a solid return on investment. Zillow home values average $164.6K, providing a good balance between affordability and potential appreciation. The area is popular with students and young professionals due to its vibrant community and easy access to the university and downtown attractions.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

46637: North South Bend & Notre Dame

- Gross Yield: 15%

- Annual Revenue: $34,705

- Zillow Home Value: $232.4K

This zip code covers areas around North South Bend and Notre Dame, making it one of the most desirable locations for short-term rentals, particularly during football season and university events. The gross yield of 15% and annual revenue of $34,705 highlight its profitability. Zillow home values are higher at $232.4K, reflecting the premium associated with being near the university. The constant influx of students, alumni, and visitors provides a steady stream of rental demand throughout the year.

46619: Western Avenue & Kennedy Park

- Gross Yield: 13%

- Annual Revenue: $16,174

- Zillow Home Value: $123.5K

Zip code 46619 includes neighborhoods along Western Avenue and around Kennedy Park, which are more affordable yet still offer decent rental income potential. With a gross yield of 13% and annual revenue of $16,174, the area is suitable for investors looking for budget-friendly properties. Zillow home values average $123.5K, making it the most affordable option on this list. The ongoing community development efforts and its location near key transportation routes could enhance the area’s rental appeal over time.

Conclusion

These South Bend zip codes provide a range of investment opportunities, from high-yield suburban areas to prime locations near Notre Dame. By capitalizing on the city’s diverse economy and vibrant cultural scene, investors can maximize their rental income while benefiting from property appreciation.