The dream of owning a profitable Airbnb can quickly turn into a nightmare if not approached correctly. This blog post dives into the essential strategies and practices that help investors like you avoid common pitfalls and ensure each investment is profitable. Learn how to identify the right properties, what are terms like Airbnb income potential, gross yield and annual revenue, how to avoid bad data, and make informed decisions that lead to success.

Additionally, we will explore the importance of why partnering with the right STR specialist is essential and introduce you to our partners who have an impressive investing track record in the last two years: 140 cash-flowing properties, allocating over $70 million!

Identifying Profitable Properties

What makes a short-term rental property profitable?

Profitability depends on multiple factors including location, property features, and market demand. Our expert team uses a data-driven approach to identify properties that promise significant cash flow and meet your investment goals. Our team analyzes Airbnb income potential, identifies required amenities and projected revenue to ensure the properties you consider are likely to be successful.

Check out the video below and click here when ready to be connected:

Avoiding Common Pitfalls

How can I avoid common mistakes in short-term rental investments?

Knowledge and preparation are key. Many investors fall into traps like underestimating costs, amenities or misjudging market saturation. Having the right data and partner to help you navigate these challenges, ensuring you make a profitable investment from the start is important. This is why Chalet provides essential, trustworthy data on your market of choice, and analyzes short-term rental regulations to provide you with accurate financial insights.

Strategic Investments

What strategies can increase a property’s profitability?

Selecting the right amenities, understanding demographic preferences, and optimizing property listings are crucial. The approach of our team includes a thorough market analysis and property evaluation to align your investment with demand trends. We focus on determining Airbnb profitability and maximizing your Airbnb revenue through strategic investments.

Financial Considerations

What financial metrics are important when choosing a short-term rental?

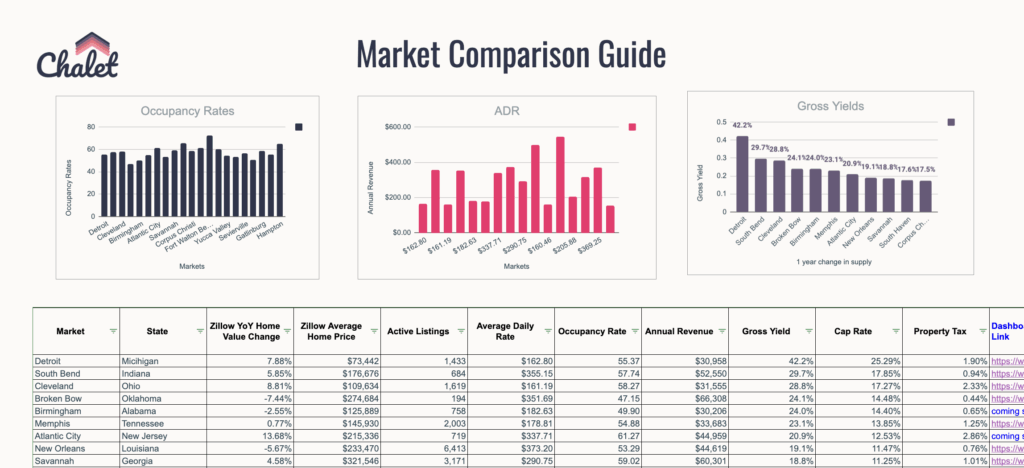

Important metrics include cash on cash return, potential revenue projections and the comps analysis. However, major indicators how a short term rental market is performing and to determine the Airbnb income potential are gross yield and annual income. Focus on properties that not only cover their costs but also generate substantial free cash flow.

What is gross yield?

Gross yield represents the total return on an investment before deducting taxes and expenses. It is often used to compare the relative returns of different investments and not just rental properties, but also bonds, and mutual funds.

Why is annual revenue important?

Annual revenue in the context of short-term rentals refers to the total income generated from renting out a property over the course of a year. This includes all the money received from guests for stays, cleaning fees, and any additional charges. When determining Airbnb income potential, annual revenue is a crucial metric, as it helps estimate the profitability of a rental property by providing a clear picture of the total earnings before deducting expenses such as maintenance, utilities, property management fees, and other operational costs.

Top 100 Airbnb Rental Markets

Instantly compare top 100 short-term (Airbnb) rental markets in the US

Expert Guidance

Why should I consider hiring a specialist for my investment?

Our team provides more than just property searches; we offer a comprehensive service that includes market analysis, financial forecasting, and investment verification. This ensures you invest wisely and with confidence. Leveraging expert guidance can help you accurately assess Airbnb income potential and navigate the complexities of the short-term rental market.

Conclusion

The path to a successful Airbnb investment is paved with strategic choices and expert insights. By focusing on the right data, avoiding market pitfalls, and leveraging professional guidance, you can ensure that every property you invest in contributes positively to your financial goals. Ready to make your next investment a guaranteed success? Connect with our data team to find the right property and start your journey towards a profitable short-term rental.