STR – Short Term Rental

Cap Rate – Also known as Capitalization Rate is a measure used to estimate and compare the rates of return on an investment property. Cap Rate is calculated by dividing the property’s net operating income from its property asset value. Formula: Net Operating Income/ Asset Value.

Cash on Cash – is a rate of return ratio that calculates the total cash earned on the total cash (equity) invested in a deal. Formula: Net Cash Flow/ Total Equity Invested.

Gross Yield – The overall return on investment without deducting expenses or taxes. Formula: Gross Income/ Asset Value

ADR – Average Daily Rate. This is basically equal to a nightly price in hotel terms.

RevPAN – Revenue Per Available Night. Formula: Total Revenue / Available Nights. Available nights are defined as nights that can actually be rented out (not blocked by the owner).

1031 Exchange – It is a swap of one real estate investment property for another one that allows capital gains to be deferred. It is basically a tax break. You can sell one property and exchange it for a new one that you purchase for the same purpose (investment), allowing you to capital gains tax on the sale.

Airbnb Turnover Service – A complete vacation rental turnover solution including Airbnb cleaning, linen rental, and on-demand amenities, all automated when your guest checks out. This is a lot more than just the cleaning service.

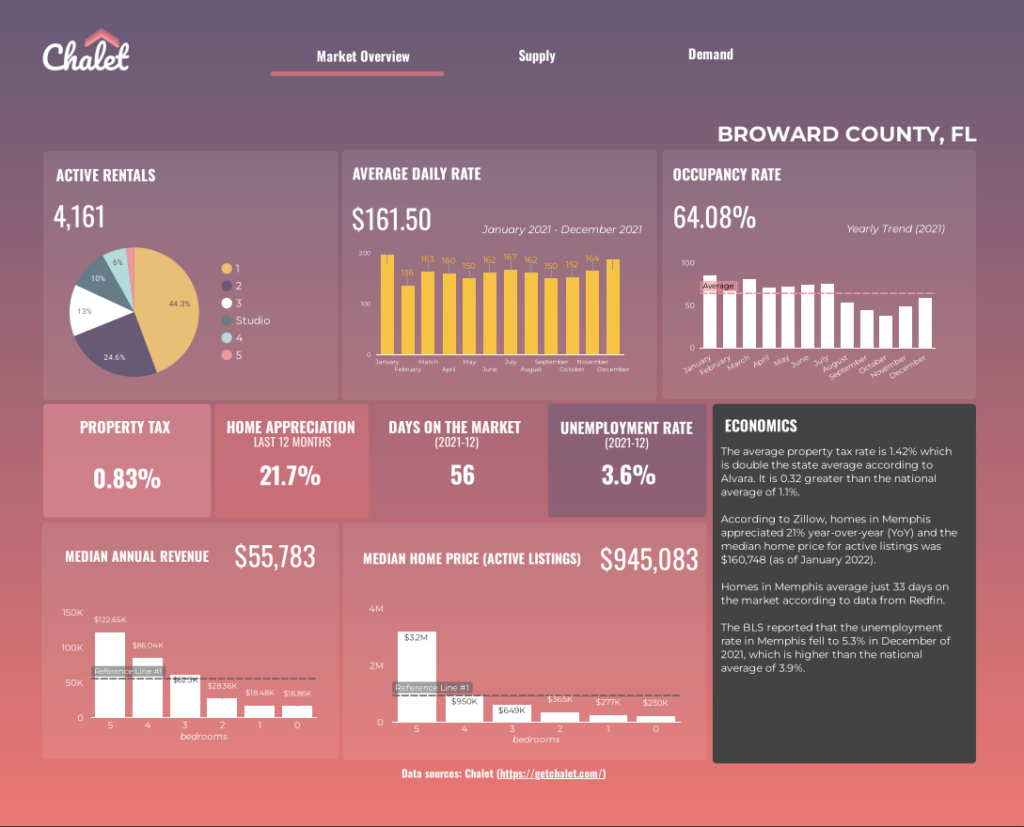

Airbnb Rentals: FREE Market Reports

Top performing properties, annual revenue, average daily rate, gross yield, occupancy rates, the most popular amenities, and a lot more…

Also, don’t forget to check out Chalet Investor’s Guide to Airbnb Rentals