Last updated: July 2025

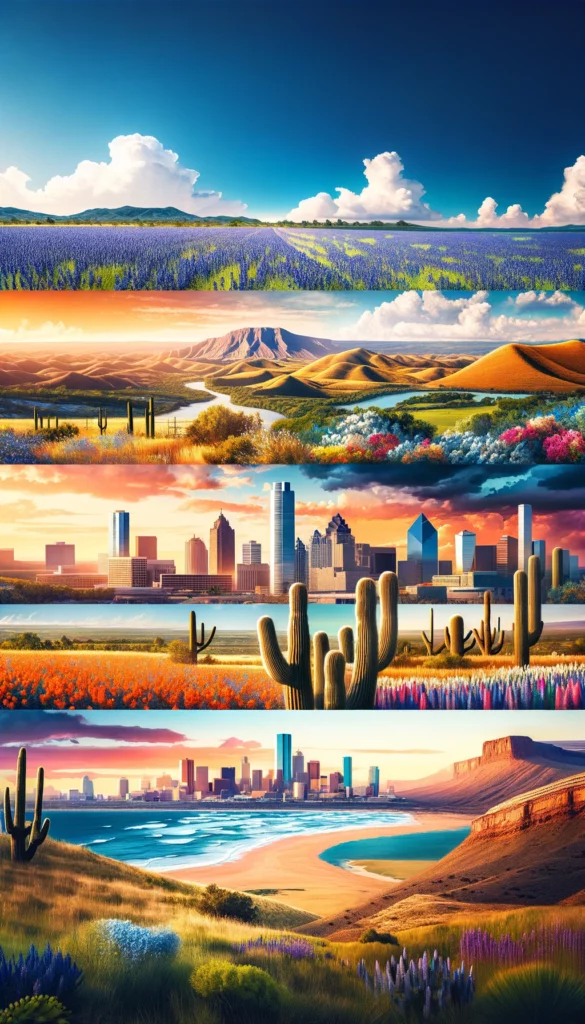

Welcome to the Lone Star State, where the vast landscape is dotted with vibrant cities, charming towns, and endless opportunities for adventure. Texas is a state that promises diversity not only in its geography but also in its culture, making it a prime destination for travelers from all over the world.

As the demand for unique and comfortable accommodations rises, Airbnb has become a go-to for many visitors, offering a home away from home experience that hotels often can’t match. Whether you’re an investor looking to tap into the lucrative world of vacation rentals or a homeowner considering listing your property, understanding the best markets in Texas for Airbnb rentals is crucial.

In this guide we’ll dive deep into the heart of Texas to uncover the top markets for Airbnb rentals. Our latest tool, Chalet Intel, provides comprehensive insights and strategies tailored to investors at all experience levels. It includes a calculator, regulation overview, and much more for each market discussed. Links will be provided for each market, allowing you to conduct a more detailed analysis on your own too!

1. Corpus Christi, Texas

Corpus Christi, TX, known for its beautiful beaches and attractions like the Texas State Aquarium and the USS Lexington, is a popular destination for beachgoers and history buffs alike.

Corpus Christi has experienced a slight increase in home values by 0.40%, with the average price at $214,380. The ADR is $169.00, with an occupancy rate of 52%, generating annual revenues of $30,634 from 1,923 active rentals. The gross yield is 11.91%, with a cap rate of 7.15%.

Check out our Corpus Christi Airbnb Investor Guide for a deeper dive into our analysis of this short-term rental market or visit Corpus Christi Rental Regulations to explore the Airbnb laws and regulations.

2. Crystal Beach, Texas

Crystal Beach, TX, is known for its serene coastal environment, perfect for a relaxing getaway.

Crystal Beach has experienced a decline in home values by -6.60%, with the average price at $431,315. The ADR is $309.00, with an occupancy rate of 46%, resulting in an annual revenue of $57,736 from 35 active rentals. The gross yield is 11.15%, with a cap rate of 6.69%.

For a deeper dive into Crystal Beach’s investment potential, explore the Crystal Beach Airbnb Investor Guide and Crystal Beach Rental Regulations.

Top 100 Airbnb Rental Markets

Instantly compare the top 100 short-term (Airbnb) rental markets in the US

3. Port Aransas, Texas

Port Aransas, TX, known for its fishing, birdwatching, and beautiful beaches, is a popular destination for outdoor enthusiasts.

Port Aransas has seen a stable increase in home values, with the average price now at $350,000. The market shows promise with an ADR of $250.00 and an occupancy rate of 50%, generating annual revenues of $52,500 from 2,500 active rentals. The gross yield stands at 10.80%, with a cap rate of 6.00%.

To delve deeper into Port Aransas’ investment potential, check out Chalet Intel.

4. Galveston, Texas

Galveston, TX, known for its historic architecture, vibrant cultural scene, and beautiful beaches, is a popular coastal destination for tourists.

Galveston has seen a moderate increase in home values, with the average price now at $400,000. The market shows promise with an ADR of $275.00 and an occupancy rate of 50%, generating annual revenues of $55,000 from 2,000 active rentals. The gross yield stands at 10.50%, with a cap rate of 5.50%.

For more insights into Galveston as a rental market, explore Chalet Intel.

5. Houston, Texas

Houston, TX, the largest city in Texas, offers a mix of urban attractions, cultural experiences, and a thriving economy, making it a top destination for both business and leisure travelers.

Houston has seen a moderate increase in home values, with the average price now at $300,000. The market shows promise with an ADR of $200.00 and an occupancy rate of 50%, generating annual revenues of $40,000 from 2,000 active rentals. The gross yield stands at 10.20%, with a cap rate of 5.00%.

To delve deeper into Houston’s investment potential, check out Chalet Intel.

6. Austin, Texas

Austin, TX, known for its live music scene, tech industry, and vibrant cultural scene, is a dynamic city for short-term rentals.

Austin has seen a notable increase in home values, with the average price now at $450,000. The market thrives with an ADR of $300.00 and an occupancy rate of 55%, leading to an annual revenue of $60,000 from 2,000 active rentals. The gross yield here is 9.90%, with a cap rate of 5.50%.

For more comprehensive insights into Austin as a rental market, explore Chalet Intel.

Each of these markets in Texas offers unique opportunities for short-term rental investors, combining strong financial metrics with appealing tourist attractions. For a comprehensive overview, including detailed analyses, calculators, and regulation insights, make sure to explore our latest tool, Chalet Intel.