1 – Define Your Investment Goals and Priorities

At Chalet, we’ve found that there are three primary types of investors:

The Pure Investor – This investor is focused solely on ROI.

The Investor Who Wants it All – This investor is focused on ROI but also wants to use the property as a vacation home. Thus, they have the desired market category (beach, mountain home, ski chalet, etc) but will pick the specific market within their desired category that makes the most financial sense.

The Vacation Homeowner – This investor already has a specific market in mind and wants to buy the property that yields the highest ROI in that specific market. This investor plans to offset the portion of its mortgage payment by renting out on Airbnb part-time.

Knowing your investor type from the beginning will help you in all aspects of your investment home buying journey.

2 – Research and Define your Mortgage Loan Type

Lenders must categorize a buyer’s property as one of the following in a mortgage application:

- Primary residence

- Second Home

- Investment Property

- Duplex / Multi-Family

The option you select will be a major factor in determining your mortgage rate and loan limits. Thus, it will be a major factor in determining your home buying budget and your potential ROI. We recommend doing research online or consulting with a mortgage professional to better understand the implications of each property type.

3 – Pick an Investment Market

Investors must be very considerate of picking markets that are Airbnb “friendly.” Almost every municipality in the US has its own set of short-term rental regulations. Each market will primarily fall into one of the following categories:

- Short-term rentals / Airbnbs are illegal for stays less than 30/31 days.

- Short-term rentals / Airbnbs are legal only for permanent residents where the home is their primary residence.

- Short-term rentals / Airbnbs are legal but only in specific city zones.

- Short-term rentals / Airbnbs are legal but have a very strict and expensive set of regulations.

- Short-term rentals / Airbnbs are legal and regulations are easy to navigate.

All investors must do a deep analysis of regulations before picking an investment market. At Chalet, we can do the nitty gritty regulations research for you so you don’t have to. We can research a market of your choice or point you to a recommended, short-term rental-friendly market.

It’s also crucial that you pick a market that fits your budget. Depending on your budget, there might be markets that are non-starters.

4 – Understand the Licensing Process form the Get-Go

Regulations and licensing go hand-in-hand. Almost every municipality requires that your property be licensed as a short-term rental or vacation rental. However, this process is different from market to market. For instance, the regulations of a specific market might be favorable for Airbnb properties but the municipality may have a license moratorium in place. You just want to make sure that if you buy the property, you will also 100% be able to license it as a legal short-term rental.

Other considerations – Make sure to check if there are any future course meetings around short-term rental regulations and licensing. You don’t want to invest in a market that is considering changing its regulations while you are going through the buying process.

You must also factor in that you might not get your license right away and thus the property will go unrented for a period of time. You need to budget this into your ROI for the property. The better you understand the licensing process, the more accurately you can analyze how it will affect your budget.

5 – Know How you Want to Manage the Property from the Get-Go

While this is typically something people consider post-close, Chalet highly recommended deciding your management approach from the get-go. Your management approach will be a huge factor in your revenue. Thus, it’s better to understand your management style up front so you can budget it as an expense. There are generally 3 types of management style for an Airbnb host:

- Hire a Full-Service Property Management Company

Hiring a full-service Property Management company is the most common approach for out-of-state investors. The benefit of a full-service PM is that they handle all aspects of the rental – cleaning crew, maintenance, turnover, etc. The negative is that they take a large amount of your revenue. PMs typically charge anywhere from 15% – 30% of each booking.

- Hire an Online Management Company and Manage Local Aspects through Vendors.

There are some PMs that manage some, but not all, aspects of your rental and they offer vendor referrals for the areas they do not cover. These PMs charge a smaller amount, typically around 10%. They cover all online components of management – listing creation, marketing, 24/7 online guest support, etc. However, they do not manage “boots on the ground” service such as your cleaning crew and onsite maintenance.

- Manage All Aspect Yourself and Hire Vendors Directly

This management style means you are responsible for lining up all aspects of your property’s Airbnb business. While this is the most labor-intensive style, it’s also (obviously) the best approach for your bottom line. While this was not a feasible route for most out-of-state investors in the past, there are now many tools to help hosts manage properties without the traditional property management model.

Regardless of which path you choose, Chalet can help.

We provide management services that empower hosts. Some of our services include:

- Airbnb and VRBO listing creation & Training

- Property Management Software and Automation Set-Up & Training

- Smart Pricing Set-Up & Training

We can also refer you to our network of qualified vendors such as Property management companies, Airbnb turnover services, and maintenance providers.

6 – Work with Chalet to Define the Investment Property Parameters

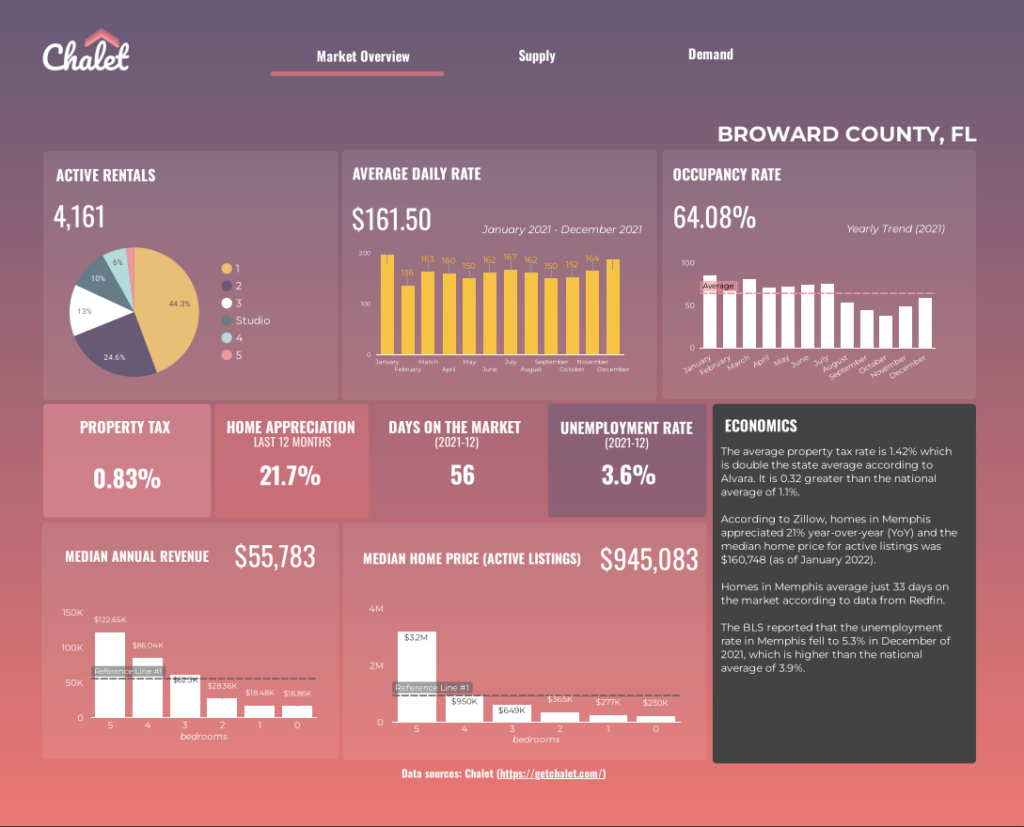

At Chalet, we rely on data to help our customers in their investment property buying journey. We do a deep analysis so our investors understand specific markets:

- Active Airbnb rentals per size of the home (number of bedrooms)

- Average Daily Rate / Nightly Price per size of the home (number of bedrooms)

- Occupancy rates per size of the home (number of bedrooms)

- Monthly Revenue Projections per size of the home (number of bedrooms)

- Median Gross Yield per size of the home (number of bedrooms)

- Real Estate Market Analysis

- Supply and Demand

- Appreciation stats

- Days on Market

- Tax implications – Property tax / rental tax

- Seasonality

- And more

This data combined with your individualized investment parameters help us narrow in on the type of houses that make the most sense for you. We also assist in pointing investors to specific neighborhoods within their desired market.

7 – Pick a Realtor Who Understands the Local Short-Term Rental Market

At Chalet, we’ve created a vendor network of short-term rental industry experts. We work to pair our clients with realtors who have experience with Airbnbs. You are not just buying a home, you are buying an investment so the realtor must understand the difference.

8 – Consider Properties from an Investor’s Mindset, Not a Homeowner

We also highly recommend going into the home showing with an investor’s mindset. This means you are looking at the property solely from its rentability potential.

Here’s a scenario – let’s say you’re looking at properties and find a place that has strong ROI potential but you don’t like some of the features – the tile, the layout, the paint colors, etc. You must push past looking at homes through your own personal preferences. There may be things that are non-starters for you personally but are not a factor in the home rentability. Chalet will help you define a wish list based on rentability.

9 – Work with Chalet to Analyze Each Property from an ROI standpoint

Found a property that sparks your interest? Chalet will help you analyze individual investment properties. We will put each of your top properties through our Short Term Rental Calculator to give you an idea of the gross yield, net income, cap rate, cash on cash, and overall investment value.

Additionally, through our Chalet Concierge Service, pull comps on live Airbnb properties similar to your properties of interest. Our data gives us information on each comps occupancy rate, daily rate, and annual rental revenue.

10 – Close on your Investment Property and start your Airbnb Host Journey with Chalet

Once you close on your investment property – celebrate! Then connect with Chalet to line up either a property management vendor or tools and services that will allow you to manage the property yourself. Either way, we are here to help!

Airbnb Rentals: FREE Market Reports

Top performing properties, annual revenue, average daily rate, gross yield, occupancy rates, the most popular amenities, and a lot more…

Also, don’t forget to check out Chalet Investor’s Guide to Airbnb Rentals